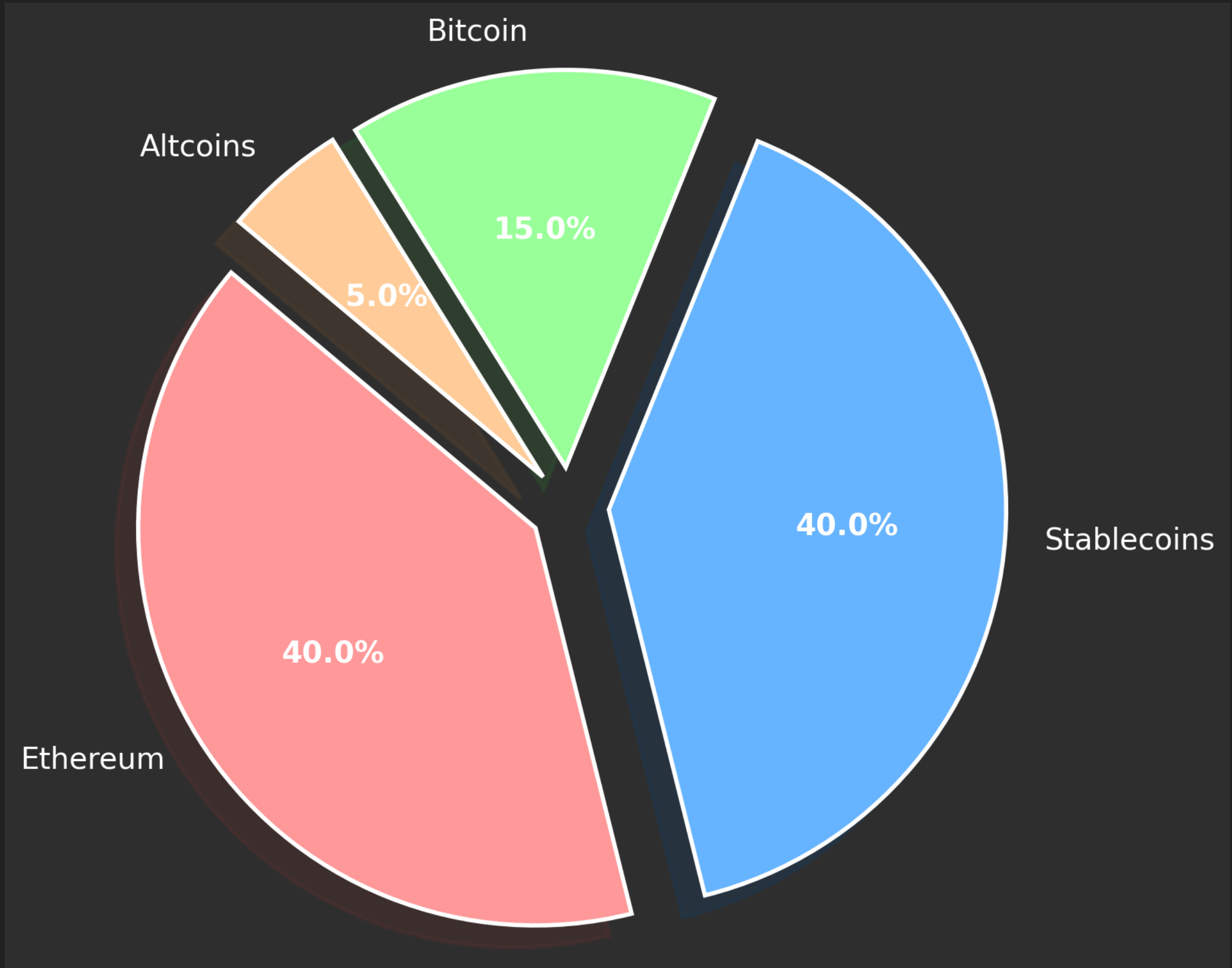

I’ve been thinking recently about what I want my digital asset portfolio to look like in 10 years time. I know I don’t want to be researching new projects and trading memecoins day in, day out, so let’s explore what a set and forget final portfolio might look like. The core values that I want to focus on are: LongevityDue to a lack of active management I want the vast majority of funds in things that have longevity and long-term horizons. I don’t want to be rotating in and out of the latest ecosystem incentives and generally avoid anything that could be time consuming. Risk AversionThere’s a time to ape in with leverage and there’s a time to protect what you have and I want to move towards the far end of that spectrum. New speculative assets are where the most opportunity lies but it’s also where the most risk awaits. FIAT BalanceAll my costs are still in GBP (British pounds) so I want to have a significant stablecoin allocation to draw down on. I don’t want to be a forced seller of Bitcoin/Eth just because my kids need to go to college. RebalancingI want to use rebalancing to remove some of the potential for human error in timing market cycles. I’ve been incredibly lucky so far and I don’t want to push that luck to think that I can predict the future. Holding a fiat balance and a crypto balance and then rebalancing to a set percentage will automate buying in bear markets and selling in bull markets. A 60/40 PortfolioHere are my targets which is nothing like what my portfolio looks like currently as I have almost zero exposure to fiat. I’ve spoken previously about price targets if/when this will change.

EthereumIf you’ve been reading this newsletter for any time you’ll know that I believe the decentralized world computer Ethereum is building will one day be more valuable than a pure cryptocurrency like Bitcoin. I’m biased as a Solidity dev but I still want the most significant portion of the portfolio to cover what I believe to be the biggest opportunity. Staking also provides a yield which is nice psychologically to spend the yield when necessary without reducing the holding balance. I have purchased a hardware node and will be setting up a Rocketpool validator to earn around 6.8% APR on this. Whether this is easily manageable and sustainable or becomes a full time job remains to be seen. StablecoinsThis is tough as I want to get a yield on fiat to offset inflation without risking the capital. Real world treasury assets could be one option. Delta neutral basis trades on futures exchanges could be another option. As much as possible I would like to take out into a tax free ISA and put into index tracking funds which isn’t necessarily pegged to fiat currency but is less volatile than crypto markets. The Luna debacle has given me PTSD despite not losing any significant funds. This would make up a significant part of the portfolio so hopefully there will become a clearer path to safe stablecoin yield in the future. This is the part of the portfolio that I’ll also be using to off-ramp for living costs and trade with when rebalancing. I’ll probably need to take on custodian risk when using centralized exchanges for the latter. BitcoinI’ve always had an allocation to Bitcoin in cold storage and I probably wont touch this but over the years that allocation has shrunk as my other investments have outperformed it. This will probably end up with my kids or used for one off expenses. AltcoinsI’ve worked in the industry since 2017 and I think this gives me a decent chance of being able to foresee emerging technology that will play an important part in the future of web3. Whether that be DeFi governance tokens or something I have a personal connection with I’ll probably always have a small balance of altcoins with which I have long-term conviction. Rebalancing ExampleThe above is a 60/40 portfolio of crypto/stable digital assets. I’ve spoken previously about this in 2020 and I still believe this is a sound strategy.  🔗 https://jamesbachini.com/6040-crypto-portfolio/ Let’s combine the crypto into a single asset CRYPTO and the stables in to USD for this example. The price of 1 CRYPTO Token is $1000 and I hold 60 of them, at this time I hold $40,000 USD on the stable side to give a 60/40 portfolio. Markets are good and the price of the crypto token doubles to $2000. The portfolio has risen in value to (60 x $2k) + $40k = $160k To get the portfolio back to 60/40 I need to sell off 12 CRYPTO tokens so the balances are now 48 CRYPTO @ $2k & $64k USD Some time later markets crash and CRYPTO goes back down to $1k meaning I need to buy back some tokens to rebalance back to 60/40. Total portfolio value is $112k so I allocate $19.2k back into crypto buying 19.2 tokens. The portfolio now stands at 67.2 CRYPTO and 44.8 USD. This is how rebalancing works, it forces you to buy when crypto is dead and sell when everyone wants lambos. It takes advantage of market cycles which I’ve written no end about but is less effective if there is a supercycle where holding as much assets as possible in crypto is optimal. For me this provides ease of mind that I have a stablecoin balance from which I am comfortable drawing down upon at any point of a market cycle. It also takes the risk, thought and stress out of trying to time markets. Crypto markets are volatile and rebalancing a 60/40 portfolio makes that volatility a friend rather than something to be feared over the long term. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Crypto End Game | The 10 Year Plan"