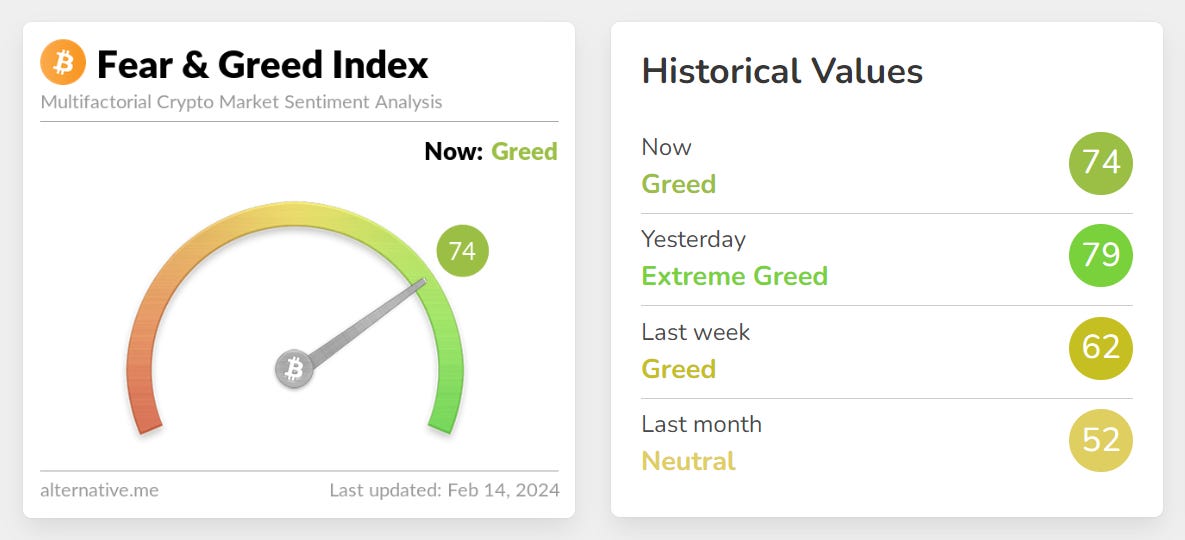

Bitcoin has broken above $50k and is continuing to grind up against the US dollar and every other fiat currency. This is what it was designed to do and markets look strong going into the halving around the 21st April 2024 (exact date can’t be predicted yet). There is perhaps a case that we are starting to see an acceleration in the price appreciation since the ETF approval as more funds are pouring in from traditional finance.

This accelerating price movement puts us ahead of schedule for the 4 year cycle. I don’t believe the four year cycle will last forever but there is some considerations on how this might play out if we continue to accelerate into the halving. Scenario 1. The PullbackPrice action has been so strong since late 2022 that we haven’t seen the 30-40% pullbacks that hurt so bad in previous cycles. This could be down to a number of factors such as the spot to leverage ratios and the reduction in volatility over time as markets mature. A pullback to $42k or even all the way down to $30k would be painful in the short term but wouldn’t invalidate the potential for another high time frame bull market. This would be healthy and shortlived I expect due to the market expectations. Scenario 2. The SupercycleI still believe that 3AC were perhaps just too early on their supercycle theory. Eventually Bitcoin will reach a plateau where it’s adoption reaches a peak. At that point it’s value will be driven more by the devaluation of fiat currencies than growing adoption and utility. This will see a more steady, less volatile asset grind up at a multiple of inflation caused by the increasing government money supply. An accelerating cycle contradicts this but it could be the setup that drops us into a supercycle if markets get excitable too early and then it comes back down to form a steady upwards channel. Scenario 3. Left Translated CycleI first heard about this from Bob Lucas and it’s a fancy term which means an early bull market. Bob’s content is excellent and is well worth checking out if you have a chance.  The scenario basically envisages ETF demand pushing Bitcoin into a new ATH, then the snowball effect from media coverage accelerates it further towards $100k and beyond earlier than previous cycles. In the video above he talks about the potential for a down cycle as well which is terrifying and I hope I’m not still working in the industry if we get a prolonged 12 year bear market where hope is lost. For developers, founders and investors it would be a lost decade. On a brighter note the left translated cycle means we get Lambo’s earlier, if hodlers can time the markets and ignore million dollar Bitcoin predictions. Scenario 4. The Crowded TradeOver twenty thousand Bitcoin holders watched that video and Bob has over 100k subscribers. Everyone I speak to isn’t selling at $50k because why would we when the price is expected to reach $100k in the next year? Perhaps the 4 year cycle has become a crowded trade. when everyone is in a trade they all lose money I wouldn’t be surprised to see Bitcoin accelerate towards $100k in a left-translated cycle and then reverse as it hits the first significant resistance around that level. The miners are becoming less and less influential to the selling pressure and if everyone is planning on selling some of their holdings at that same psychological milestone it may be a more significant factor than the halving itself and the cycle. Whatever happens we are lucky that we still have a four year cycle intact for now and the hopium that it will continue to generate wealth for eternity, however impossible that may be. The BTC/USD weekly chart is moving further and further away from it’s 30 week moving average which currently sits at $35k. As seen in previous cycles it can stay above this for some time but not forever. We are now firmly in the early (optimistic) mid (realistic) late (pessimistic) stages of a new bull market. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Early Bull Market - Left Translated Cycle"