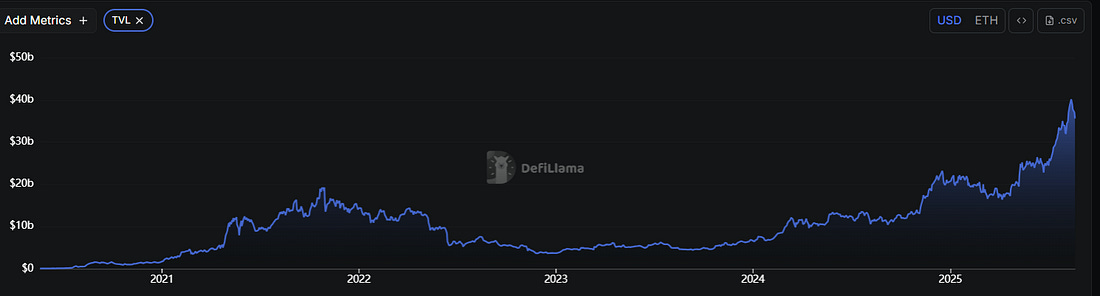

This week has brought about a small pull back as BTC fell nearly 10% from $124k to $112k I used the opportunity to scope up some Aave governance tokens and rebalance my other alt holdings. Aave is the second largest DeFi protocol with $36B in TVL. The core product is an overcollateralized lending protocol. Deposit one asset, borrow another. Various reasons to do this such as leveraging up a position, tax advantages and creating short positions. It’s a DeFi primitive and has clearly found product market fit in a growing sector. The tokenomics have improved alongside the TVL, and fundamentals, with a new token buy back scheme set up in April. There are also new products being released and showing promise such as the GHO stablecoin which can be minted based on deposits in the same way you can borrow other assets. I expect treasury companies like MSTR, SBET, BMNR etc. will continue to purchase BTC/ETH for dollars and those dollars will be going to early adopters selling their coins. Many market participants are either currently selling or looking to cash out a portion of their holdings into stablecoins in the next year and I expect a lot of those funds will end up in Aave and other platforms offering yield on stablecoins. Currently Aave deposit rates are between 5-10% APR on USDT/USDC. This isn’t the best rate available (especially compared to leveraged yield strategies) but it is perhaps the lowest risk due to the lindy effect (Time x TVL = Proven Security) Investors looking for a home, for large quantities of funds they can’t afford to lose, will naturally gravitate towards Aave in my opinion. This should continue to increase TVL over the next decade and the token valuation should follow. The token buy back program started in April and repurchases $1m/week currently. This has the potential to be ramped up if fees can grow with general DeFi adoption. The timing is a little off as buying altcoins in the later stages of a bull market doesn’t usually end well but I was reallocating funds from other digital assets. I think it’s quite important to avoid moving up the risk curve as confidence grows in positive market conditions. I’m happy to hold this for 10+ years if necessary but expect we might see DeFi regain the limelight before then. Currently AaveRank lists the platform as 39th compared to AUM of FDIC insured banks vs AAVE deposits. Deposits listed on this site is $63B, the leading tradfi bank JP Morgan has $3.78T. Huge room for growth if DeFi can capture institutional market share. Credit: https://x.com/Excellion/status/1957144716031795274 Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Buying Aave On The Dip"