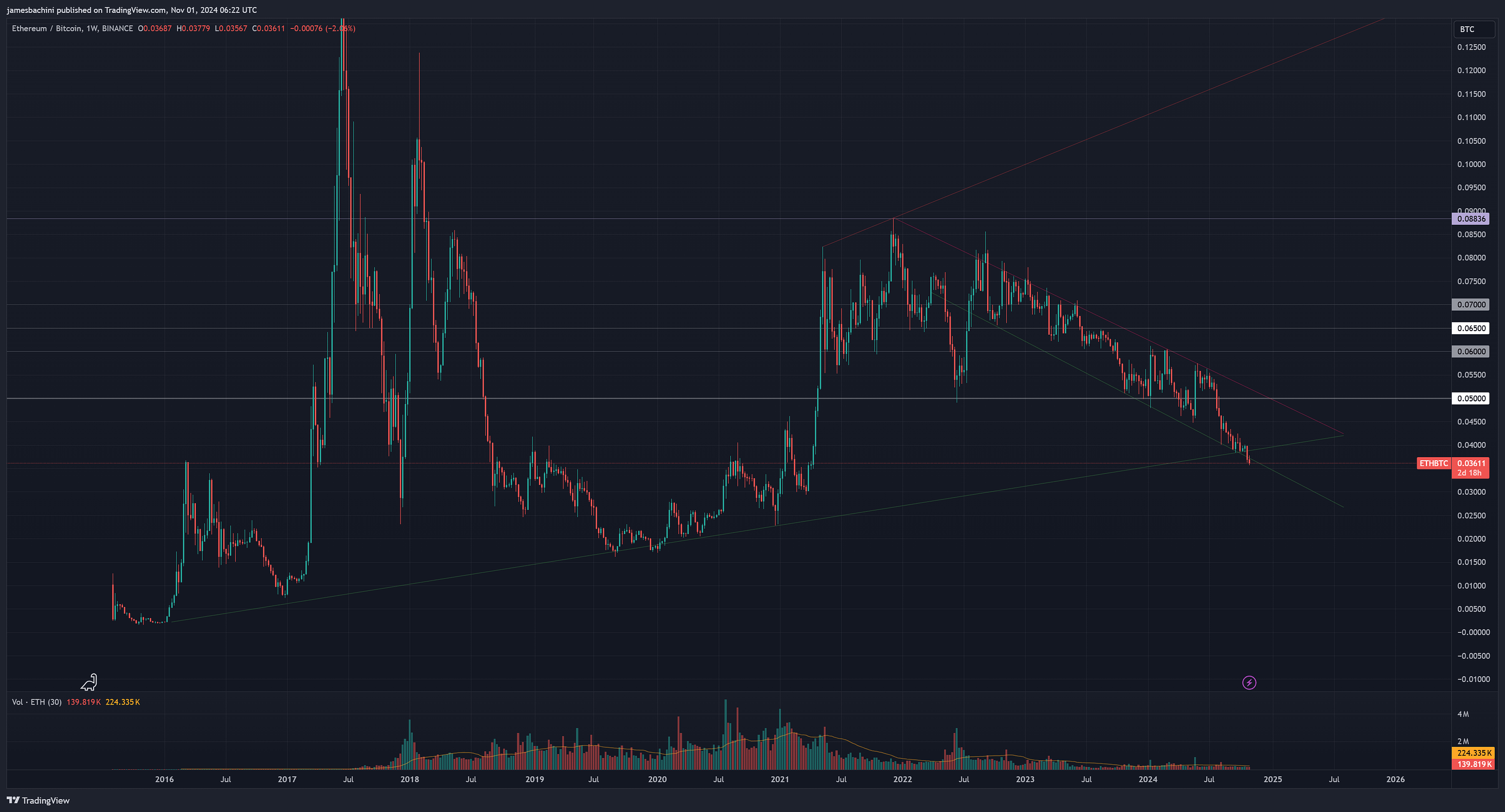

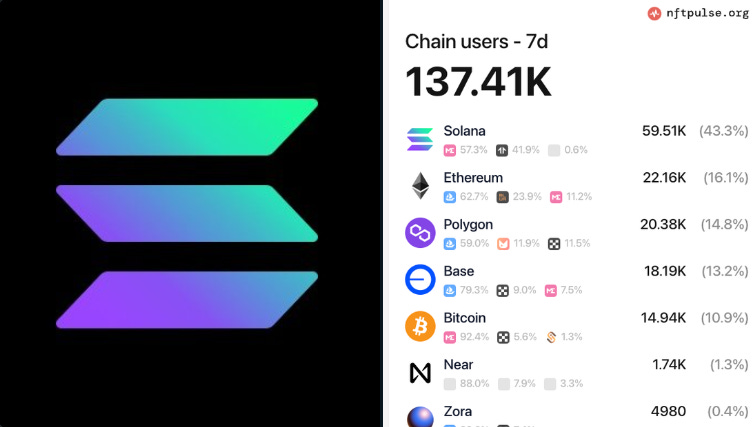

Yesterday I finally pulled the trigger on a trade that has been on my mind for some time. It was uncomfortable, went against consensus and recent price action. Bitcoin’s outperformance this year led it to having an expanding position in my portfolio of >40%. Ethereum’s underperformance is seeing ETH/BTC trade at the 0.035 level. Sentiment for Ethereum is as low as I’ve ever seen it. In less than a year it’s gone from being the most loved project to the most hated. This started with ETFs and Bitcoin outperforming because of Wall St demand. Fundamentally it's still the leading smart contract platform by a wide margin and from a devx perspective it's hard to catch up. Competing smart contract platforms are still a long way behind in terms of TVL and infrastructure. I think there will be two avenues for blockchain developers over the next 5-10 years.

I’m perhaps the last person standing that is still bullish on web3 and the potential for decentralized computing to disrupt our reliance on cloud providers. This has far reaching implications from social media to gaming to DeFi. It probably sounds absolutely crack pot crazy to say but I still believe Ethereum (or another smart contract platform) will have a higher market cap than Bitcoin one day. This is simply because the value and utility of a shared world computer is greater than that of a pure and elegant cryptocurrency. For the trade I sold half my Bitcoin for Eth which leaves me a second bullet and gives my portfolio the following ratio:-

I’m still actively shopping to try and increase my alt exposure. Would be happy to reduce the ETH exposure by 10-20% to take advantage of any emerging opportunities in the markets. I don’t like the fact my digital asset portfolio is so concentrated around a single asset and my net worth now relies on Vitalik more than I care to admit. Not something I would recommend to anyone reading this. I managed to get the trade through between 0.035-0.036, here is the chart which admittedly looks like a memecoin going to zero. But this isn’t a memecoin. In my opinion smart contracts are here to stay and the opportunity for developers to deploy immutable code on a decentralized p2p network is important and will capture future value. If I’m right about Ethereum one day flipping Bitcoin by market cap then that level is around ~0.155 so there’s significant upside potential to 4-5x in Bitcoin terms. Bitcoin will make a new all time high first and attention should rightfully be focused on that achievement. If that happens soon it could ignite the markets and we could see a significant breakout after months of being range bound. In this scenario I expect ETH/BTC may fall further but I would rather fire this now than risk missing the move. On the downside if ETH/BTC continues to fall I have the second bullet I can fire. Perhaps around the 0.02 level as that would be capitulation. This would be an even harder trade to pull the trigger on 🥹 For me the risk to reward is there and I have high conviction/bias from working in the industry. The spot ETF infrastructure is in place albeit with no demand from Wall Street currently. If the web3 thesis plays out this will come in due course and demand for “shares in the world computer” could be impactful. This is reliant on developers building great things and hopefully I can contribute in a small way to the resources and tools available. Uncomfortable trades are something I’m slowly learning to appreciate. The last real big one was buying the blood in the streets when Luna and FTX collapsed. In hindsight it was obvious and an $18k entry on Bitcoin was a blessing but it never felt like that at the time. Hopefully this trade will go the same way and sentiment will shift again at some point in the future. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

.png)

0 Komentar untuk "ETH/BTC - My Biggest Trade Of The Year"