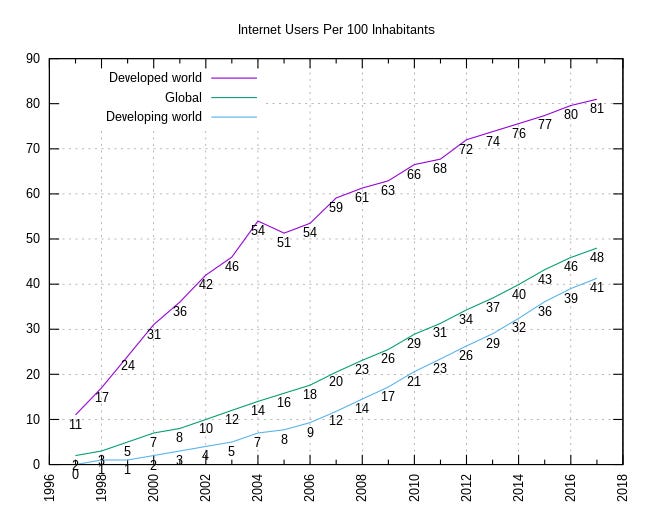

With Bitcoin’s increasing acceptance and reach is it worth considering where the saturation point is, who is the next greater fool? The concept of the greater fool theory is simple. You buy an asset hoping to sell it to someone else at a higher price, believing that there will always be someone more foolish than you to take it off your hands. How far along the growth curve are we?Let’s start by taking a look at the growth of the internet which is probably the most disruptive adoption cycle ever. Global growth was steady and predictable and looks to be continuing, particularly in developing nations. The developed world already has an 80%+ adoption rate so there’s a ceiling on the expansion capacity. Crypto is very different and it’s hard to imagine a utopian future where 80% of the population is trading memecoins. If we look at the Bitcoin active addresses chart there’s also a concerning stagnation where we are at the same level now as in 2017… This is perhaps some sought out confirmation bias for my own hopium thesis that we haven’t seen a “crypto comeback” yet and the next wave of adoption will follow a massive price appreciation phase as seen in previous cycles. It is concerning however that Bitcoin is trading near all time highs and there aren’t significantly more users to what there were seven years ago. This is a stark contrast to the internet adoption metrics we looked at earlier. You could make an argument that participants now have deeper pockets as we’ve seen more institutional investors enter the space. One Michael Saylor has a bigger impact than a hundred thousand retail investors. Who Will Buy Future Bitcoin?Could Bitcoin ever truly rival fiat currencies for everyday transactions? The short answer is no, at least not likely in our lifetimes. The transaction times and fees are still too cumbersome for small, everyday purchases. The lightning network hasn’t gained any real traction and Bitcoin mainnet was never optimal as a payments protocol and adjusting the code to target that niche is unfeasible. The narrative has shifted to it being a store of value, digital gold which remains impractical for everyday use. Perhaps in the future we’ll have a mobile app, that stores your invested funds in stocks and crypto and then converts it to fiat when you need to spend it. We are already seeing applications like that with companies like Revolut but the regulations and UX isn’t ready yet for wide adoption. Bitcoin's growth might find its next wind from other sources. One potential driver is the dedollarisation. If less global demand leads to the dollar weakening, Bitcoin could become a more attractive store of value. Hyperinflation could push individuals and institutions to seek alternatives like gold and Bitcoin. But wishing for such scenarios is dangerous, as they would bring massive negative social and economic impacts. As a store of value, can Bitcoin compete with gold or bonds? Its market is growing, but it has a long way to go before it can truly rival these traditional assets. Gold has a millennia old history as a store of value, while bonds offer a promise of fixed returns. Bitcoin, with its volatility, still needs to prove itself in this regard. Younger generations are growing up with the technology and the “rat poison critics” are fading away. This does provide a massive market to grow into with $27 Trillion dollars in US Treasuries outstanding currently and Gold holding a $15 Trillion dollar market cap. Bitcoin currently has a $1.3T market cap which provides some headroom for it to capture some of this capital allocation. There was a lot of talk recently at the Coinbase State of Crypto summit where advisors and funds are widening their recommended allocation from 1% → 3-5%.

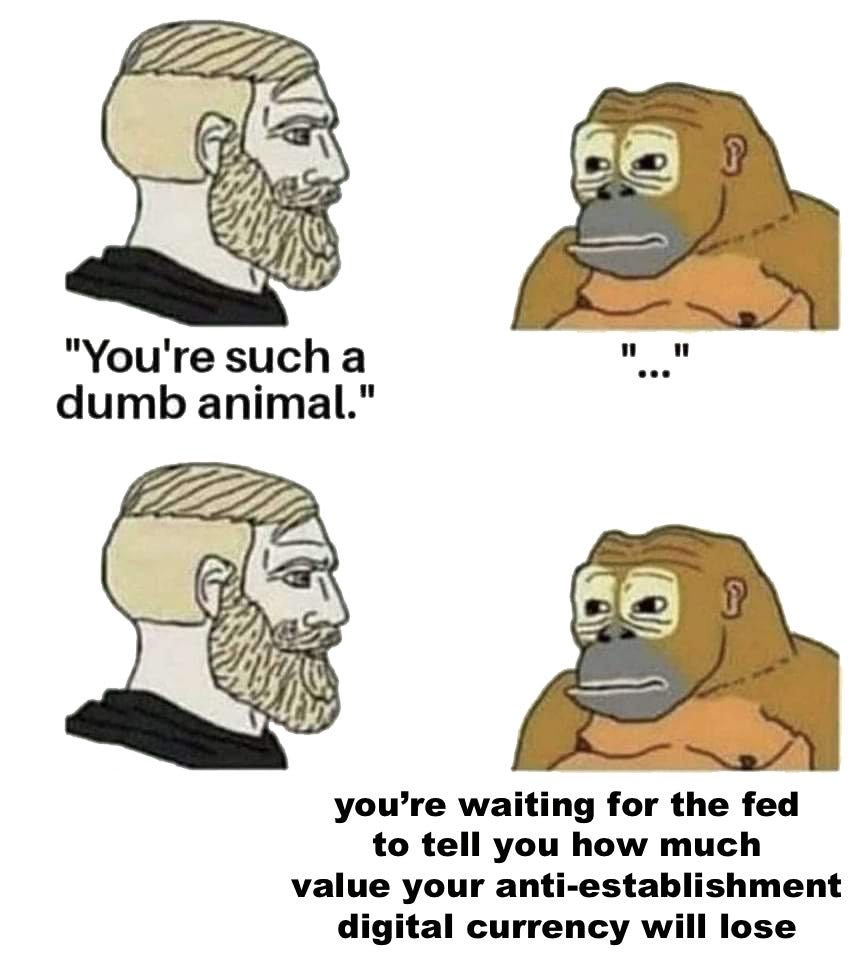

The financial market's potential is vast, but there is a ceiling. The end game for Bitcoin might see it stabilising as a digital store of value, a hedge against inflation and a way to protect wealth rather than gain wealth. How far are we from this levelling off? It's hard to say, but as the market matures, the explosive growth we've seen will inevitably slow. So, who is the next greater fool? With Bitcoin more accessible than ever, there’s very few potential buyers who don’t have access or the ability to hold BTC. The next phase of adoption wont come from speculation but allocation. The Fed maintained interest rates and signaled for a single cut at some point in 2024. It was what the markets expected but not what they wanted and we’ve seen digital assets cool off this week. Bitcoin is currently trading in this ascending triangle and it’s somewhat likely we see some wicks into liquidity to take out stops and create a few liquidations if we go much lower. It’s still only a 10% candle away from making another new all time high this year which makes it very hard to find bearish arguments. ETH/BTC is retracing a bit but holding above the key 0.05 level as altcoins continue to bleed. Potentially any significant drop or liquidation cascade in the majors could provide an opportunity for anyone looking at low liquidity assets like governance tokens and NFT’s. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Who Is The Next Greater Fool?"