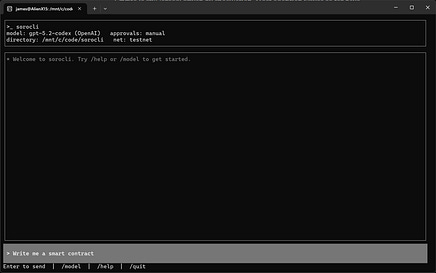

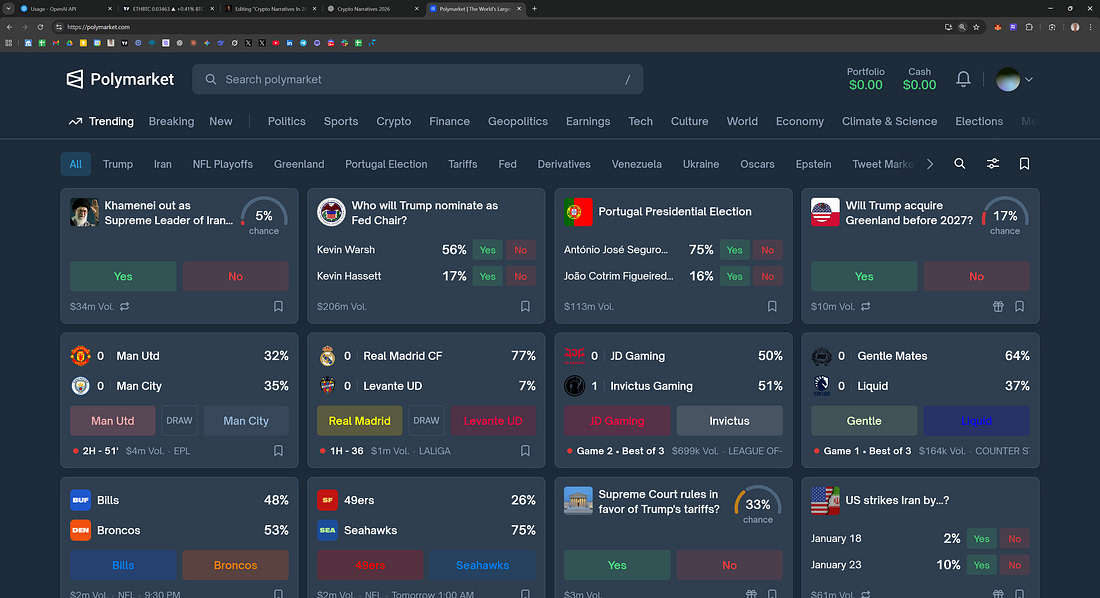

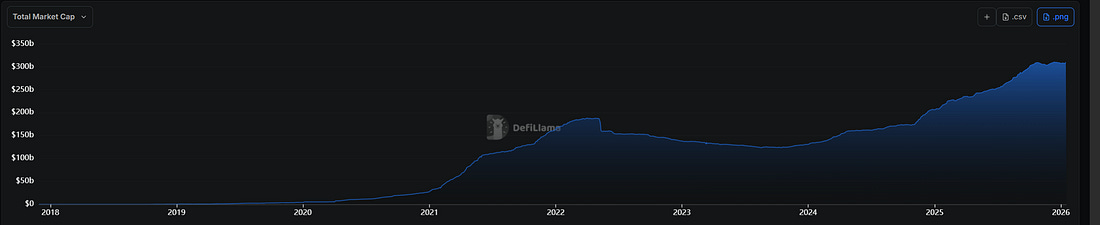

Crypto adoption is still largely driven by speculation. Most waves so far have come from perceived opportunity rather than everyday utility: ICOs, DeFi, NFTs, memecoins. Developers, traders, and investors all tend to migrate towards wherever upside appears. Let’s explore where we might see the next opportunity… 1. The Rise Of The Non-Technical FounderAI has fundamentally changed how software is built. Most developers now spend far less time writing code and more time describing intent, constraints, and outcomes. This creates an opportunity for non-technical founders who understand users, markets, or regulation but not low level engineering. This time last year I wouldn’t have trusted any of the LLM’s to write a smart contract. Now I wouldn’t trust a human written contract without at least running it by a model before deploying. I expect to see more stories of individuals vibe coding million, if not billion dollar products. 2. Prediction MarketsPrediction markets are growing quickly, with Polymarket emerging as a clear leader. Traders see these markets as more transparent and less manipulated. Sports betting provides a huge opportunity for growth and it’s a world cup year in 2026. There are opportunities emerging in this sector such as tracking wallets that could possibly have insider information on certain outcomes. If traction continues and the amounts at stake grow it could become the default betting playground. The secondary effect is that we get this source of truth from the markets where participants are financially incentivised to find true value through probabilities. 3. Tokenized StocksTokenized stocks may be the largest opportunity. A more permissive regulatory environment makes on-chain equities viable, and the capital allocated to markets dwarfs crypto. There are large pools of funds in digital assets which are waiting for programmable, always on, global stock markets. I expect this will see explosive TVL growth in 2026 and beyond. 4. Privacy an zkEverythingMost smart contract protocols are working towards enabling some form of privacy infrastructure. This technology is built on top of zero-knowledge cryptography and it’s opening up new possibilities for developers. Towards the end of last year I participated in the Aztec token sale (developers behind the Noir DSP) and it was one of the better roll outs I’ve seen in recent years. In traditional finance we expect our financial transactions and balances to remain private and enabling this on-chain is going to create a better user experience. 5. StablecoinsStablecoins are approaching a tipping point. As the Lindy effect kicks in, they will be seen less as “risky cryptocurrencies” and more as financial infrastructure. Borrowing and lending platforms offer attractive yields and institutions are warming to the sector. This has knock on effects for dollar markets across DeFi which could benefit from the growth in stablecoin TVL. Dex’s like Uniswap and Curve and borrowing/lending platforms like Aave and Blend come to mind. 6. GameFi & Web3Gaming and web3 social feel inevitable but slower. On-chain gaming like a decentralized p2p poker game seems so obvious I’m just surprised noone has done it yet. Decentralized social networks where users own their data make sense conceptually, but user experience and onboarding is not there yet. Possibly longer term plays rather than defining narratives for 2026 but I wouldn’t be surprised to see a breakout dApp. 7. DerivativesHyperliquid has seen great success with it’s semi-decentralized perpetual futures platform. Perp’s are the bread and butter of crypto and I expect this market to continue to grow with networks and platforms competing for attention and TVL. Products such as options contracts are well suited to digital assets. There are other sectors that remain under-developed such as forex and commodity trading. Decentralized finance creates room for disruption and I believe the opportunity to bring these on-chain is growing. Successful crypto narratives do not emerge because they are elegant or ethical. They emerge when incentives, timing and belief align. The next big thing in crypto might be just around the corner and the opportunity in 2026 is to identify any speculative trends early. Keep an eye on Bitcoin’s approach to $100k and ETH/BTC breaking out of it’s long-term channel over the next month. The four year cycle suggests we should be balls deep in a bear market but it doesn’t feel like that. Bitcoin continues to grind up and Ethereum is holding it’s own. Alts haven’t been resuscitated yet but optimism and is potentially just a few candles away. Positive sentiment is quietly and cautiously returning. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "The Speculative Roadmap for Crypto in 2026"