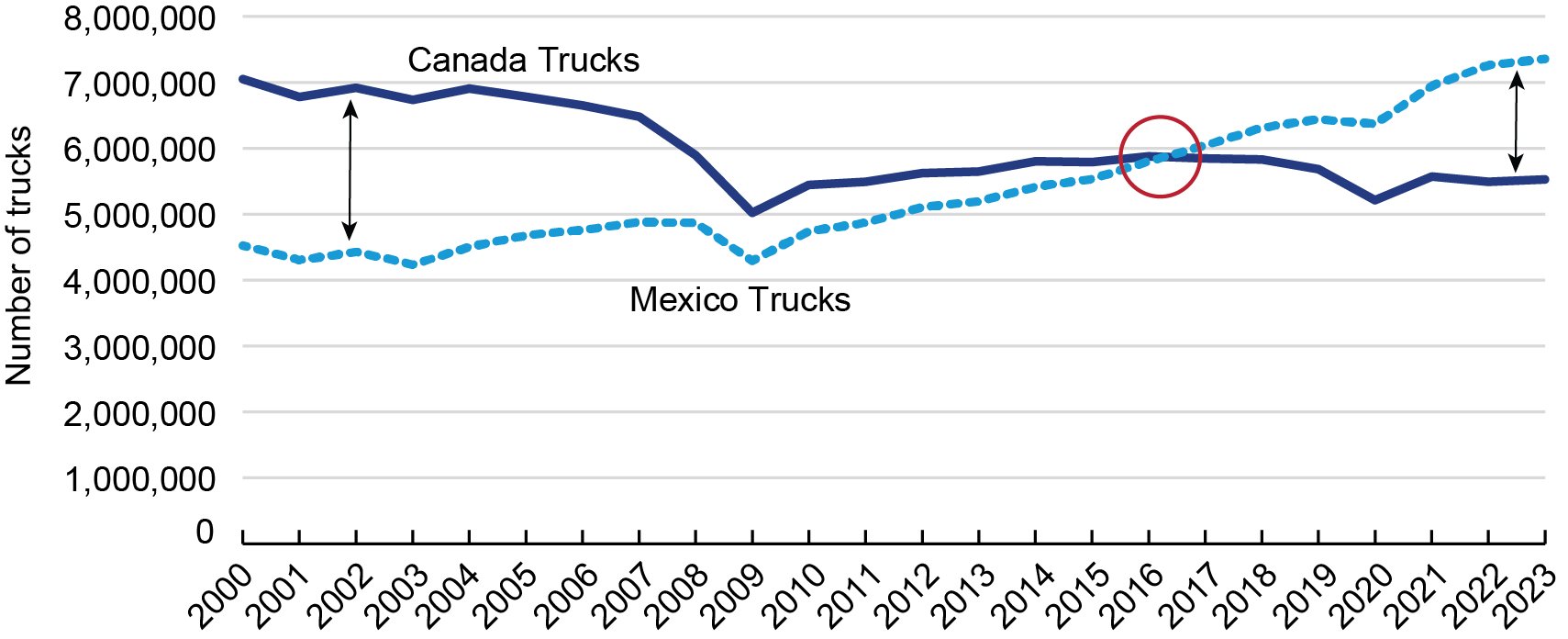

BTS Data Reveals Long-term Trend Emerging in North American Freight TruckingFriday, December 20, 2024 According to the Bureau of Transportation Statistics North American freight data, a long-term trend is emerging between U.S., Canada, and Mexico freight trucking. This report provides the data behind these trends in North American freight flows, highlighting changes since 2017 in the volume and value of truck traffic between the U.S., Canada, and Mexico. BTS Border Crossing data reveals that, starting in 2017, the trajectory of incoming trucks from Canada and Mexico began to diverge. Since 2000, the number of trucks from Canada have been decreasing while in contrast the number of trucks from Mexico have increased. From 2000 to 2023, the number of trucks from Canada decreased 21.6% from 7,048,128 to 5,526,056 while trucks from Mexico increased 62.6% from 4,525,579 to 7,356,659. Collectively, the data indicate a shift in North American cross-border trucking. The data shows Mexican freight flows are growing faster than Canada. This trend reflects changes in manufacturing, trade patterns, and supply chains in the North American freight market.

North American Freight Trucks: 2000 - 2023

Source: Bureau of Transportation Statistics, Border Crossing Data, available at https://data.bts.gov/stories/s/jswi-2e7b

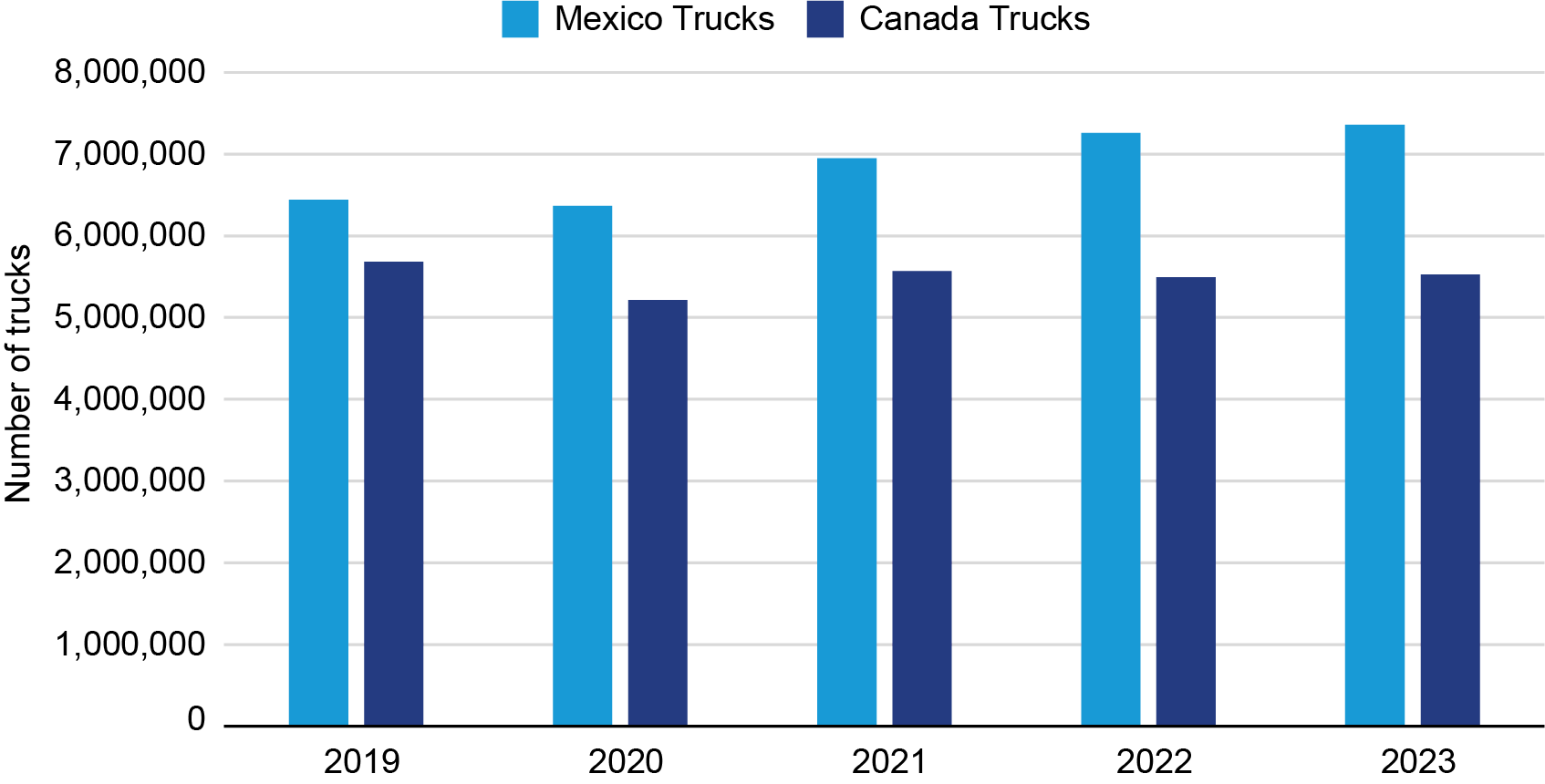

From 2019 to 2023, the number of commercial trucks entering the U.S. from Mexico rose 14.2% from 6,440,255 to 7,356,659 while trucks from Canada fell 2.7% from 5,681,155 to 5,526,056.

Incoming Trucks from Canada and Mexico: 2019 - 2023

Source: Bureau of Transportation Statistics, Border Crossing Data, available at https://data.bts.gov/stories/s/jswi-2e7b

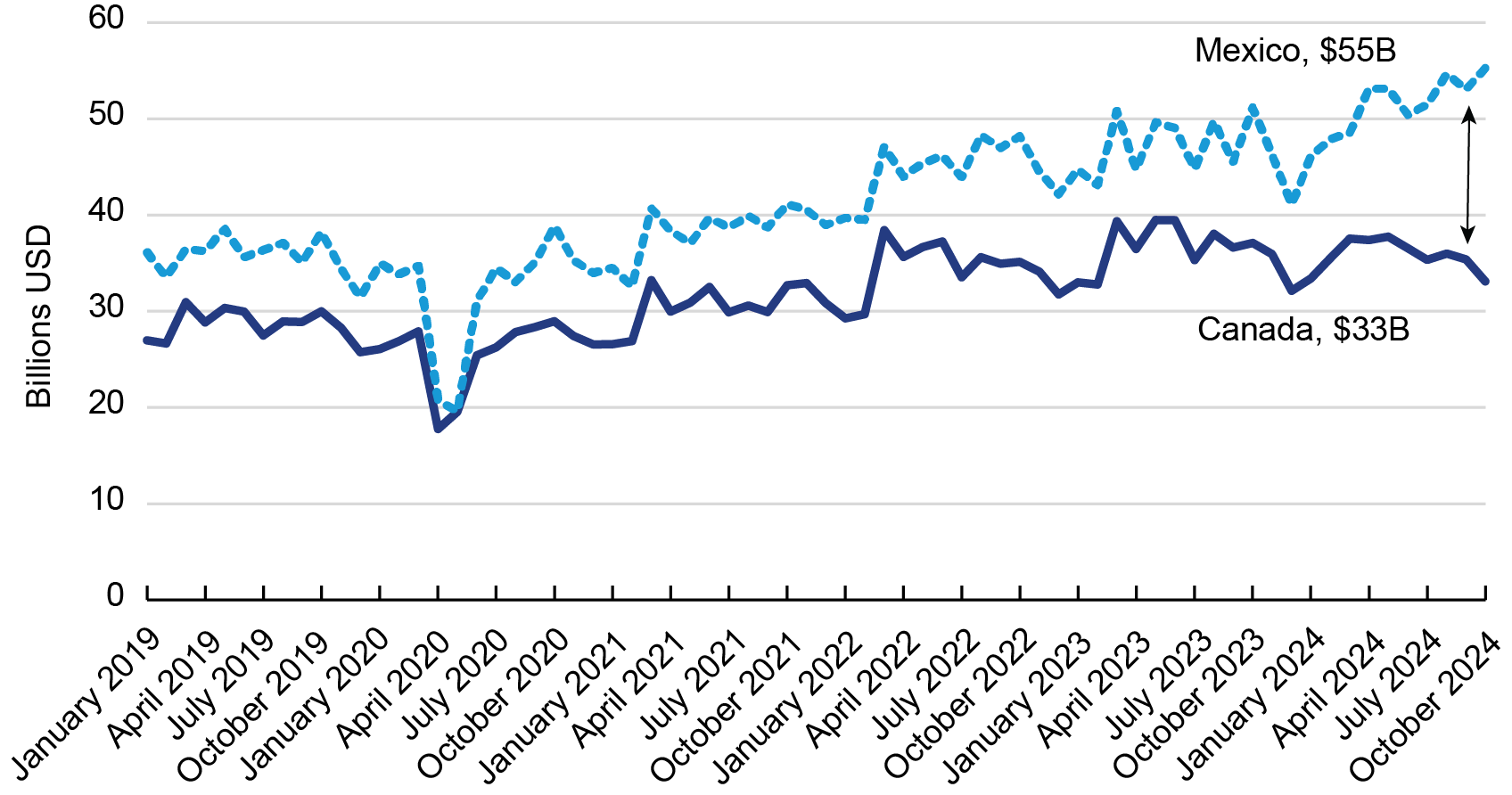

In terms of dollar value of truck freight, BTS TransBorder data shows a similar trend. Since the pandemic in 2021, the value of freight flows carried by truck with Mexico have increased while simultaneously decreasing with Canada. From April 2020 to October 2024, the value of U.S. freight flows with Canada by truck increased 86.4% from $17.8 billion to $33.1 billion while the same measure of freight flows with Mexico increased 166.3% from $20.8 billion to $55.3 billion. For a detailed breakdown of the composition of commodities by mode and geographic detail, please see recent BTS data spotlight report titled Transportation Commodity Brief: U.S. Freight Flows with Canada and Mexico in Transportation Commodities.

North American Freight by Truck Value: 2019 - 2024

Source: Bureau of Transportation Statistics, Transborder Freight Data, available at https://data.bts.gov/stories/s/myhq-rm6q

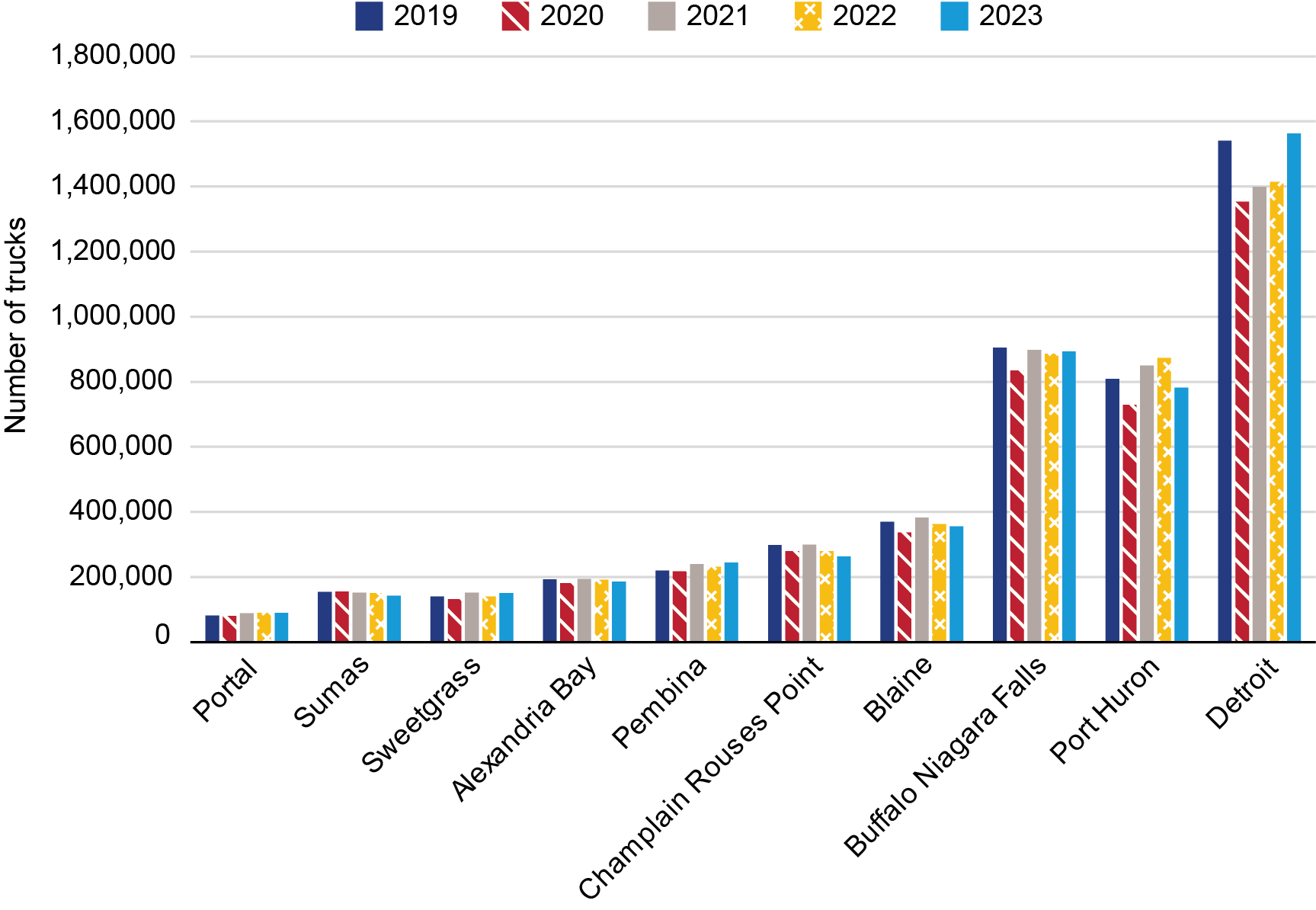

From a geographic perspective, the land border port at Detroit handled 1,562,531 incoming trucks in 2023, slightly increasing by 1.4% from 1,541,294 trucks in 2019 for the first time since the pandemic.

Top 10 Northern Border Truck Ports: 2019 - 2023

Source: Bureau of Transportation Statistics, Border Crossing Data, available at https://data.bts.gov/stories/s/jswi-2e7b

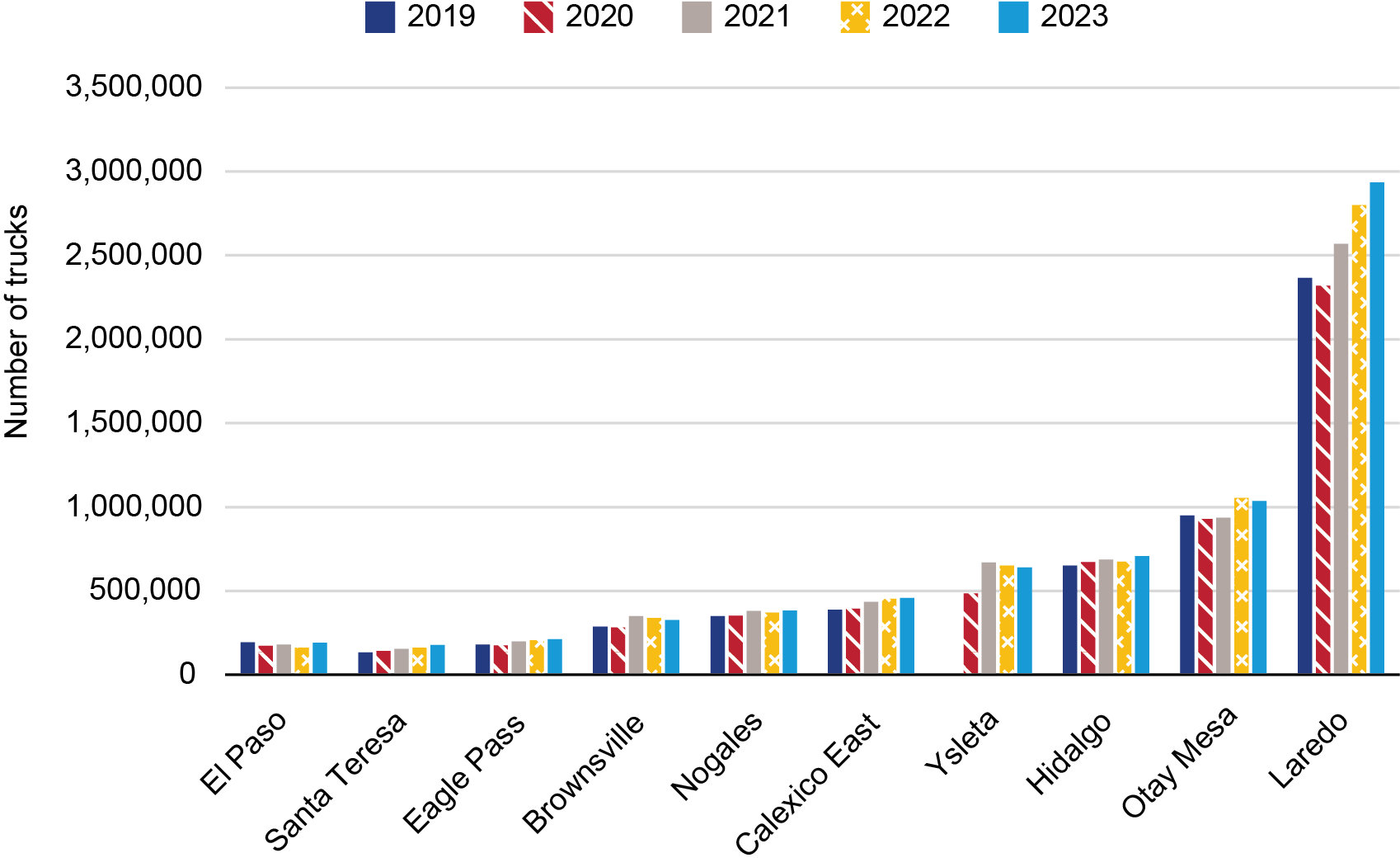

Commercial truck activity along the Southern land border continued to show robust growth. Laredo, which is the largest gateway for trucking in North America, handled nearly 3 million incoming trucks in 2023 that represented a 24.2% growth from 2019.

Top 10 Southern Border Truck Ports: 2019 – 2023

Source: Bureau of Transportation Statistics, Border Crossing Data, available at https://data.bts.gov/stories/s/jswi-2e7b |

Beranda » Tanpa Label » BTS Data Reveals Long-term Trend Emerging in North American Freight Trucking

0 Komentar untuk "BTS Data Reveals Long-term Trend Emerging in North American Freight Trucking"