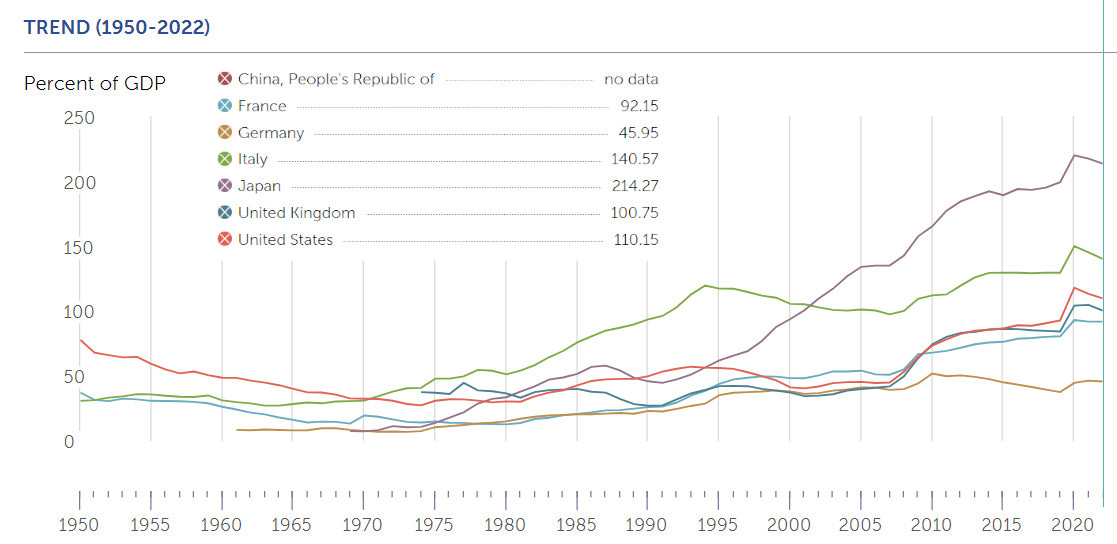

According to the World Economic Forum global debt now exceeds $300 trillion, including government, corporate, and household debt. The chart below shows long-term trends in government debt as a percentage of GDP.

Governments are borrowing more. Top of this list is Japan which was in the news because they increased interest rates by 25 bps. This affected a nice trade in financial markets where individuals & corporations with access to capital could borrow Yen for next to no interest and invest it in something with yield to make a profit. Market participants were spooked by higher borrowing costs causing some to unwind the trade, selling of global assets to buy back Yen and pay off the original loan. JPY/USD spiked and then looks to be continuing it’s downtrend against the dollar and everything else. This important to blockchain developers and digital asset holders because it’s a prime example of how spiralling debt has caused knock on effects which led to market shocks affecting global markets, including crypto. Can Debt To GDP Go Up Forever?The only viable strategy to reduce or even sustain government debt is through inflation which can reduce the real value of debt over time, making it easier to reduce deficits. The 2% targets aren’t going to cut it but this is a double edged sword because higher inflation risks economic instability. Can’t the governments just print money to pay off debt? Expanding the money supply leads to higher inflation and therefore interest rates. The government may need to borrow even more to cover rising costs and imports, leading to a vicious cycle. The problem is that the governments around the world are never going to come together and agree to pay off all their varying debt levels at once. If one country does it alone they risk devaluing their currency and undermining global confidence in their financial system. But if a country can not balance their books and continues to run a high deficit then they will struggle to compete long-term with countries that can. Not all countries are accumulating debt equally, here's a list of G20 countries and their Debt/GDP level alongside the most recent data for fiscal deficit/surplus to GDP percentages *

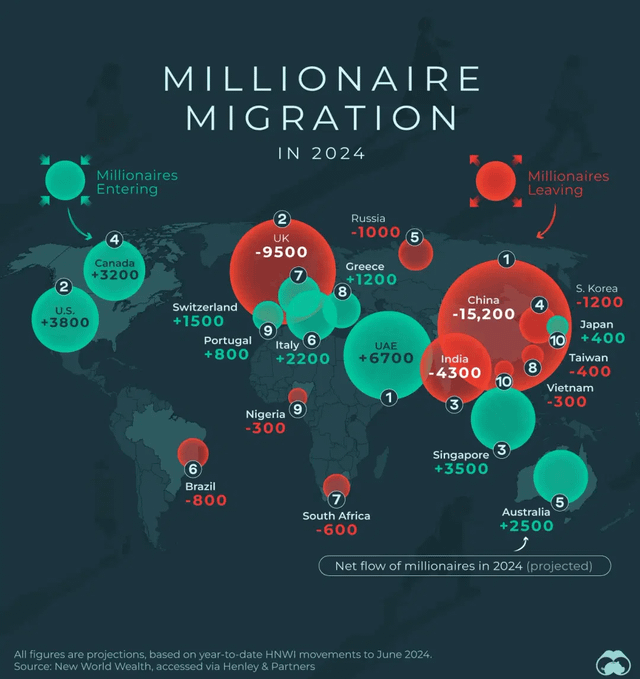

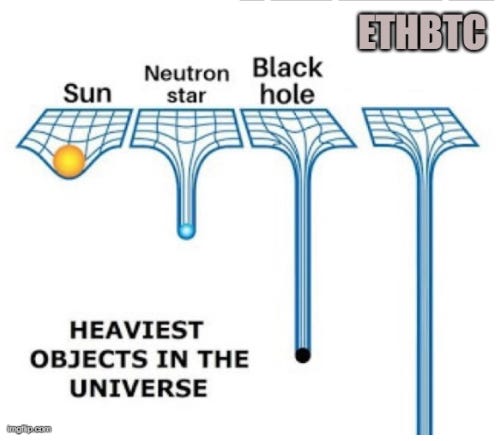

If one country needs to inflate their currency to decrease the value of spiralling debt then this goes down in value against strong currencies and hard assets. The country will then find that exports become more competitive but imports become more expensive. Potential Debt Death SpiralCountries have a few options to balance the books, we’ve discussed expanding the money supply, other options including raising taxes and cutting public spending. When raising taxes they will need to balance managing debt against global market competitiveness. This can cause knock on issues too and we are perhaps already seeing it as this infographic shows an exodus of high net worth individuals leaving the UK for tax havens like the UAE. The world has become a competitive arena for your tax dollars and countries like UAE are so rich in commodities they can afford to tax less which is attractive to the people that pay the most tax. Many countries offer a long-term visa to applicants that can prove they have a certain amount of funds or income level. At last check pre-rich memecoins and governance tokens don’t count. This could arguably cause a draining effect leading to less entrepreneurial tax generating populations further reducing GDP and increasing the deficit/GDP levels. Is Austerity The Answer?If countries can’t raise taxes past a certain point without causing damage to tax revenues through an exodus of corporate and individual tax payers, then the only other option is to cut spending. The problem is that this would require unpopular political decisions and in most western countries politicians have short 4 year time frames. They are incentivised to appeal to voters needs now, not their children’s needs in 30 years time. Austerity measures are politically unpopular and any political nominee that wants to get a vote will need to promise lower taxes and higher public spending. In the UK, since Covid, we’ve seen a pull back in public services and significant attempts to curb expenditure. Go on the Facebook group for any village, town or city and you’ll see complaints about infrastructure such as pot holes in roads, power cuts, waste collection etc. Public sector pay freezes alongside high inflation have created a “cost of living crisis” for many. Still we can not balance the books and while the deficit has reduced since Covid we are still in a debt spiral. I expect this is a similar situation for many nations around the world to greater or lesser degrees. Back To BlockchainsWhat does all this mean for digital assets? From what we’ve discussed above, it is inevitable that fiat currencies continue to increase their totalSupply, inflation will be higher for longer and debt in real terms is reduced or sustained through inflation of the currency. As fiat currencies inflate it means that the value of all other assets goes up relative to the devaluing currency. Predictions of $1 million dollar Bitcoin seem inevitable when you take this into context. It’s just a matter of time. We wait, it’s what hodlers do. Bitcoin is either in a bull flag and has been idling over summer (as expected), or this is just cope and it’s over for another 4 years. Sentiment is negative, funding rates on Binance Bitcoin futures are negative as well which you don’t see all that often. There’s no demand for leverage and optimists are few and far between. Polymarket is predicting just a 19% chance of a new ETH all time high this year. Altcoins aren’t being bid, NFT’s are illiquid. There’s not much good news out there right now. I personally think this is the calm before the storm and it’s getting near time to go on a digital asset shopping spree. Two more weeks of summer and then everyone returns back to work and refocuses on speculating away their net worth. I believe there is a reasonable possibility of a big move in Q3/Q4 and a new all time high for both ETH & BTC. The risk to reward on this is favourable as ETH is at roughly 50% off it’s all time high. I expect the odds of it making a new ATH in the future at far greater than it going to zero. Moving up the risk ladder to governance tokens, NFT’s and other high volatility assets leverages this exposure, hence the potential for a shopping spree. And if that doesn’t work out Bitcoin is going to $1m eventually anyway for reasons discussed above so we will just have to wait longer. This is my biased view as a blockchain developer working in an echo chamber, do your own research. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Will Deficits Destabilize Global Markets"