A disjointed newsletter this week as there are 4 things I want to discuss.

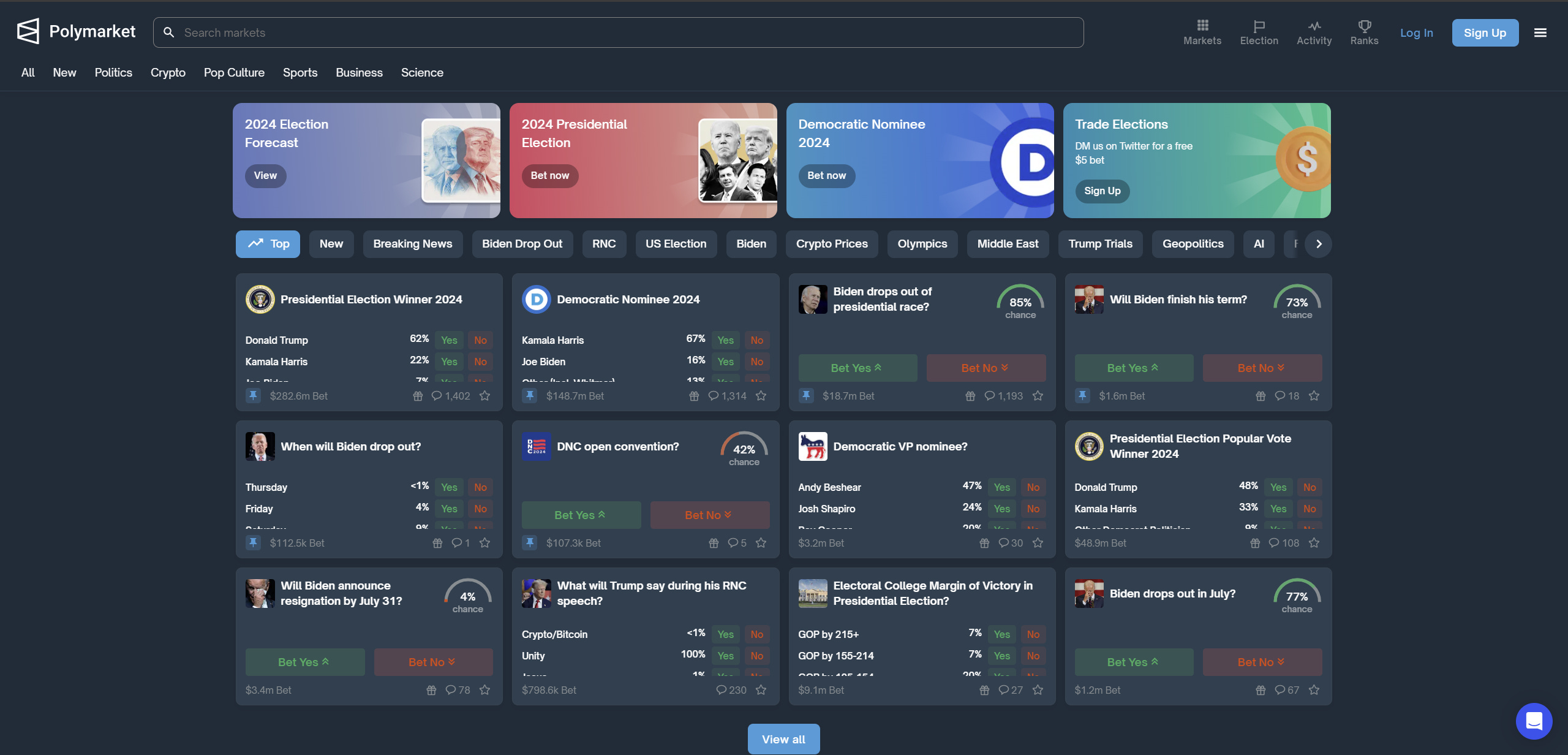

Prediction MarketsIf you’ve never visited a prediction market take a look at https://polymarket.com which seems to come alive around election time with markets for political events. The top two markets for election winner and democratic nominee have a combined $430 million USD wagered on the outcome. This volume suggests that a) they’ve found product market fit and b) there is a strong, established, open, observable market for the event. Legacy media has been broken and biased for a long time, we create echo chambers on social media to immerse ourselves with people we share similar opinions with. Neither are ideal to use as a source of truth. I’ve been reading Basic Economics by Thomas Sowell recently in which he talks about the efficiencies of markets to distribute scarce materials to the highest bidder to meet real demand. As prediction markets grow their ability to seek out truth will become more and more efficient.

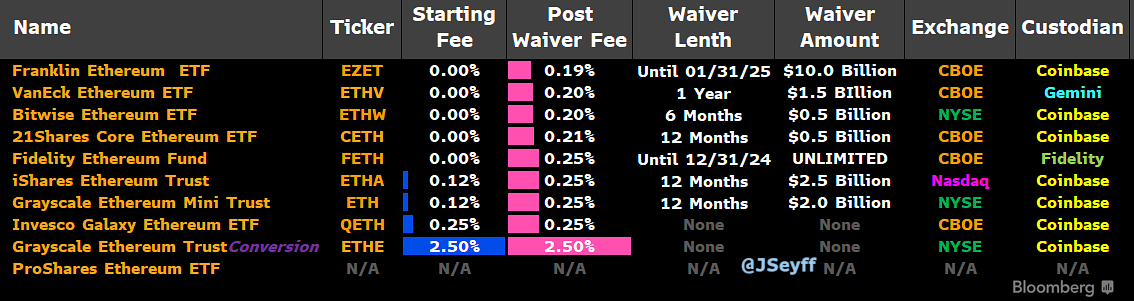

It’s a running joke that blockchain devs can’t find a real use case for crypto while innovations like this create new efficiencies and are gaining traction as we speak. Biden Stepping DownThe rant above came from the rumour that Biden might step down over the next week. The $18.7m Polymarket “Biden drops out of presidential race?” predicting an 83% chance he does drop out. There’s a smaller market for when he will drop out with dates being bid as follows: The volume on this market is only a hundred grand with Saturday/Sunday/Monday being highest bid. If this market is accurate it would suggest a 62% chance he steps down by this time next week. The Trump TradeWhen the shooter missed it created an iconic image that will go a long way to cementing the next president of the USA. A potential victory for Trump could significantly impact markets, including equities and cryptocurrencies. Investors anticipate that Trump's pro-business policies, such as deregulation and tax cuts, will revive sectors like small caps, energy stocks and more generally pump risk assets. This expectation, alongside the potential FED pivot, has been part of the driver that has taken the S&P500 to recent new all-time-highs. The blockchain sector has been hit hard by aggressive regulation and legislation from the SEC under a Democratic government. Trump is perhaps the most pro-crypto, capitalist president we could ever wish for. There’s even speculation that he is going to create a National Bitcoin Treasury which seems about as tangible as his plans to build a wall*. Regardless a Trump presidency is expected to bring a lighter regulatory touch, creating a more favourable environment for digital assets and decentralized finance. Ethereum ETF’sThe final amendments are being filed and Ethereum ETF’s, which are likely to start trading next week. Blackrock’s iShares Ethereum Trust (ETHA) is likely to be the highest volume and there will be a rotation from Grayscales Ethereum Trust to the other ETF’s just like we saw with GBTC. Demand for Ethereum on Wall Street isn’t going to be as strong as Bitcoin. It’s generally perceived as silver to Bitcoin’s gold and doesn’t have the same brand awareness. The value as a world computer for decentralized data processing is not priced in. It might take a decade for Ethereum to roll out a network of enshrined zkEVM’s, at which point they can compete with legacy web technologies like cloud computing platforms, at which point the tradfi markets might catch on to the fact that this is not Bitcoin’s little brother. We’ve reclaimed the range above $60k after a failed breakdown. At this point any good news or positive narratives makes the higher boundry of that range around $70k vulnerable which would likely lead to a new all time high for Bitcoin. On the downside $60k would really need to hold as a drop below the range for a second time would be very bearish. Ethereum ETF approval is going to have an effect on ETH/BTC and BTC.d, will it be a sell the news event or is there going to be significant initial demand? Short term it’s uncertain but over the next few years having the ETF’s in place on the NYSE opens up the asset to every traditional finance firm. This proved very beneficial to Bitcoin this year and I expect it can only really be seen as a positive for Ethereum over a longer time frame. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Prediction Markets, Biden & ETH ETF"