Crypto markets are unique in their sensitivity to narratives and attention shifts fast throughout the industry. Unlike traditional markets, where fundamentals and long-term projections often drive investment decisions, the crypto world thrives on the latest trends and emerging technologies. Narratives around new subsectors or innovations can rapidly attract investor attention, driving up prices and creating lucrative opportunities.

The life cycle of a cryptocurrency trend begins with a new technological breakthrough or concept gaining traction. This could be anything, such as:

🚀 Consumer dApps Account abstraction will change how a decentralized application operates opening them up to the potential of mass adoption as the technicalities of using a wallet get obfuscated. I’ve been waiting patiently for the killer crypto app to emerge since 2017 and I think we are getting closer. Account abstraction makes adoption easier increasing the potential for a positive viral coefficient and exponential growth. Imagine if some degenerate truly decentralized gambling thing took off like TikTok did across the globe.

🎮 GameFi Leveraging blockchain for creating decentralized gaming economies where players use digital assets to buy in game items. Imagine playing football management games and trading players for real funds.

📈 Telegram Trading Bots we’ve seen projects emerging already which play the liquidity pool sniper game and make trading ERC20 tokens as easy as a chat conversation. Security concerns aside these seem to be doing well.

👤 SocialFi Platforms like Friend.Tech where social media influencers and content creators can monetize their content and audience engagement through tokenization. The friend.tech token launch will be interesting to see how much momentum they can drive back to the product which has lost favour.

🎚️ DeFi Leverage Trading this is a proven product market fit on centralized exchanges where futures volume is 5-10x the trading volume of spot markets. There are a whole host of projects working to bring perpetual futures markets to decentralized finance, unfortunately there aren’t any traders using defi trading venues, yet.

🌍 Regenerative Finance Focusing on eco-friendly initiatives that promote sustainability. Hard to see how projects could bridge philanthropic efforts with crypto’s capitalist markets

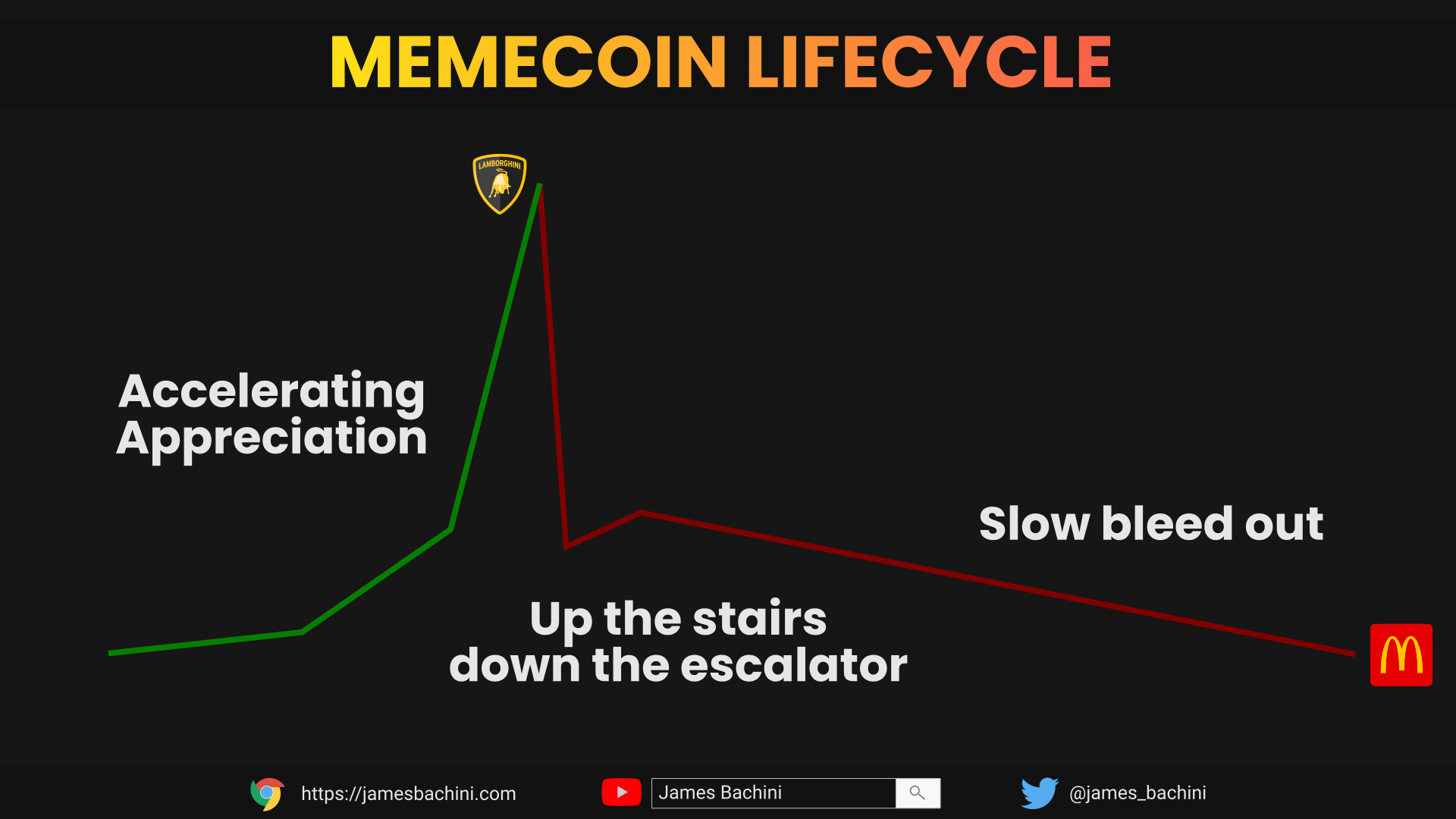

🪙 Memecoins pointless memecoins are here to stay and will likely continue to be popular and wildly traded as developers rush to rug pull late entrants to the daily emergence of new tokens. This is something where if the sector gains traction overall there will be lots of opportunities.

🔗 AppChains modular blockchains have made it possible for devs to relatively easily create their own blockchain to host their application.

🏛️ Governance If someone can make a DAO that works and doesn’t descend into chaos we might see some traction. Open, transparent and verifiable voting is a killer use case

🐼 Alt Layer 1 Blockchains every market cycle we see a new Ethereum killer take off and outperform the market significantly. EOS in 2017, Solana in 2020, what will be the new smart contract platform of 2024? or will Solana make a comeback and emerge as a long-term competitor?

🎨 NFT Expansion Evolving the scope of non-fungible tokens (NFTs) beyond art into realms like historical artifacts, digital collectibles and unique digital experiences

🛰️ Musk whatever you think about Elon he affects crypto and tradfi markets like a wrecking ball and it’s likely that there will be a digital asset aspect to X as it becomes the super app we order our food on, to be delivered by a network of driverless cars.

📚 Consumer Credit If we can solve the identity issue in DeFi we can roll out consumer credit products which opens up trillion dollar industries. Payday loans on-chain could become common and fairer than traditional models and alternatives

🤖 AI and Blockchain Convergence AI uses big data, blockchains store small data so it’s not really a thing at this point but AI is such a hot topic since ChatGPT was released that there could be a whole subsector of AI blockchain projects emerge with questionable products and services.

🛒 Payment Processors at some point we need to get to a point where digital assets like Bitcoin and Ethereum can be stored and staked safely on a mobile app and then converted to local currency and spent using Google/Apple pay as and when you make a transaction.

🌐 Metaverse Obviously Zuckerberg was too early but how far away we are from a captivating metaverse product remains to be seen. This doesn’t necessarily mean there will be blockchain technology involved but opportunities follow the attention if it becomes the hot new thing.

🕵️♂️ Privacy zero knowledge technology really is game changing and will create new ways of storing and verifying data. The right to financial privacy is contentious but there is no doubt demand for products that aren’t traceable.

The early adopters who identify and invest in the trends that actually become a thing stand to gain the most, as their investments grow with the increasing popularity of the narrative.

When a particular subsector becomes the focal point of the crypto community, it's often the leading protocol or project within that niche that sees the most significant appreciation in value. These 'first movers' benefit from the initial wave of enthusiasm and investment, frequently outperforming their competitors and establishing a strong market presence.

Lido finance is a good example of a product (stETH) that captured arguably too much market share and built a moat around it’s DeFi integrations.

However the allure of the new often overshadows established projects and for good reason. There is more potential upside on a new liquid staking projects governance token at launch than there is on Lido which now has $18B in TVL. This preference for the 'shiny new thing' can lead to dramatic shifts in market dynamics, with newer projects outperforming older ones on the way up and then getting wiped out when the music stops.

This rapidly changing landscape opens up opportunities for swing trading where the holding period is anything from a few days to a few months.

Traders can capitalize on the narrative flows by buying into emerging trends early and selling or scaling out of positions as they mature. This strategy requires a keen understanding of market sentiment and the ability to act quickly on emerging trends.

You don’t need to be first but you want to be before the crowd to get returns from from the greater fool.

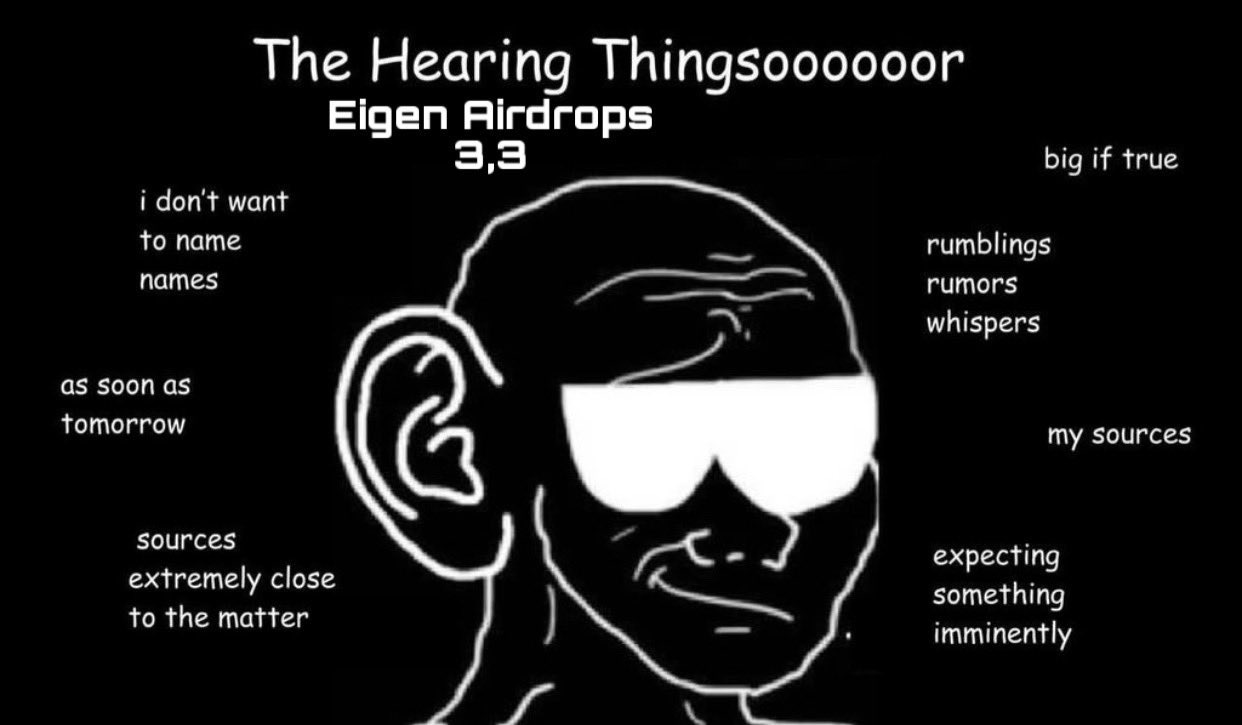

Absorb Sentiment - Keep up with the latest developments in the blockchain sector. Follow key opinion leaders, VC’s, developers, discord/telegram groups, news platforms and project socials.

Look For Signal - There’s so much noise in crypto as everyone is fighting for a limited amount of attention. In between the chaos there are small channels of signal to new technologies, opportunities or concepts. Early identification of these innovations can provide a head start.

Diversify - My chances of being able to frontrun every trend are near zero so I try to spread my bets over multiple subsectors and find at least one good project in each. These don’t form a massive part of my portfolio but they don’t need to when the potential upside is 100x.

Continuous Learning - Opportunity lies at the cutting edge of technology and the best way to see where an industry is going is to be working on the something within the sector. By using and experimenting with new systems, protocols and tools we can be the first to identify what is good from the meh.

I’ve spoken previously about order flow which plays a big part in due diligence when looking at the tokenomics of new projects within a subsector. Avoiding big VC unlocks, unfair distributions and developer soft rug pulls is key to achieving long term success.

View More

Bitcoin has sold off since the ETF in a steady fashion Monday to Friday leading to some speculation that this is due to the Grayscale GBTC product opening up withdrawals.

Prior to it being converted to an ETF it was a one way fund which was selling at a discount to the NAV net asset value for many months. This caused all sorts of drama in the industry including contributing to some of the contagion such as the 3 arrows capital collapse.

Now that it’s been converted to an ETF the gap has closed and holders are selling (not least because they are charging 1.5% management fee per year). Some of this is rotating into other ETF products and some isn’t therefore we’ve seen some negative selling pressure based on the rebalancing due to withdrawals.

Bitcoin has a few support levels at $38k, $35k and $30k which can offer risk defined trades if price gets there. Generally I’d expect to see the slow grind up continue in the mid term as we approach and following the halving event in April.

Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content

0 Komentar untuk "The Art Of Trading Narratives In Crypto"