This week Bitcoin flew through the $42k level with complete disregard to any attempt by bears to short. If momentum continues like it has the last two weeks we would be seeing all time highs in the first weeks of 2024, but…

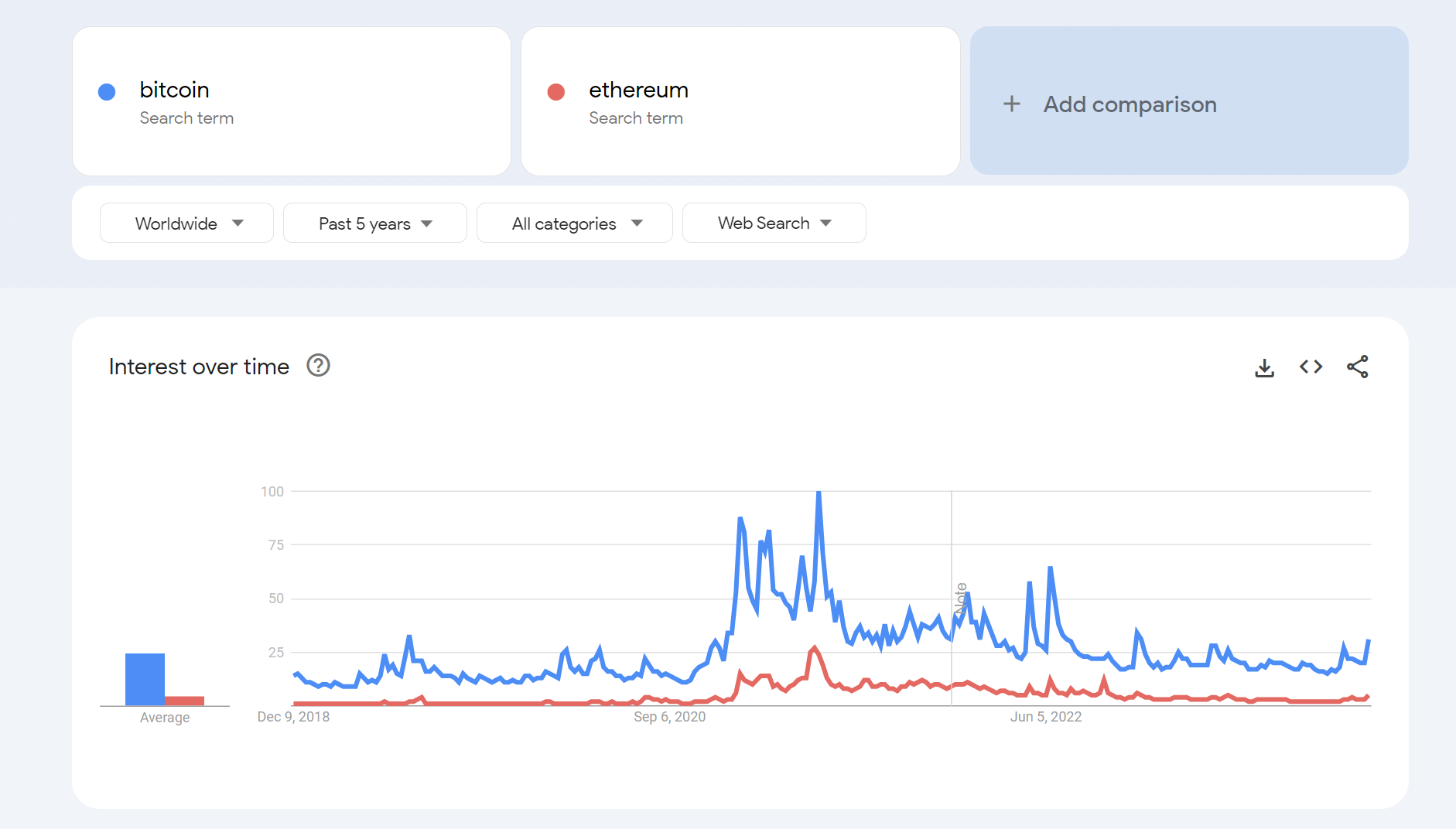

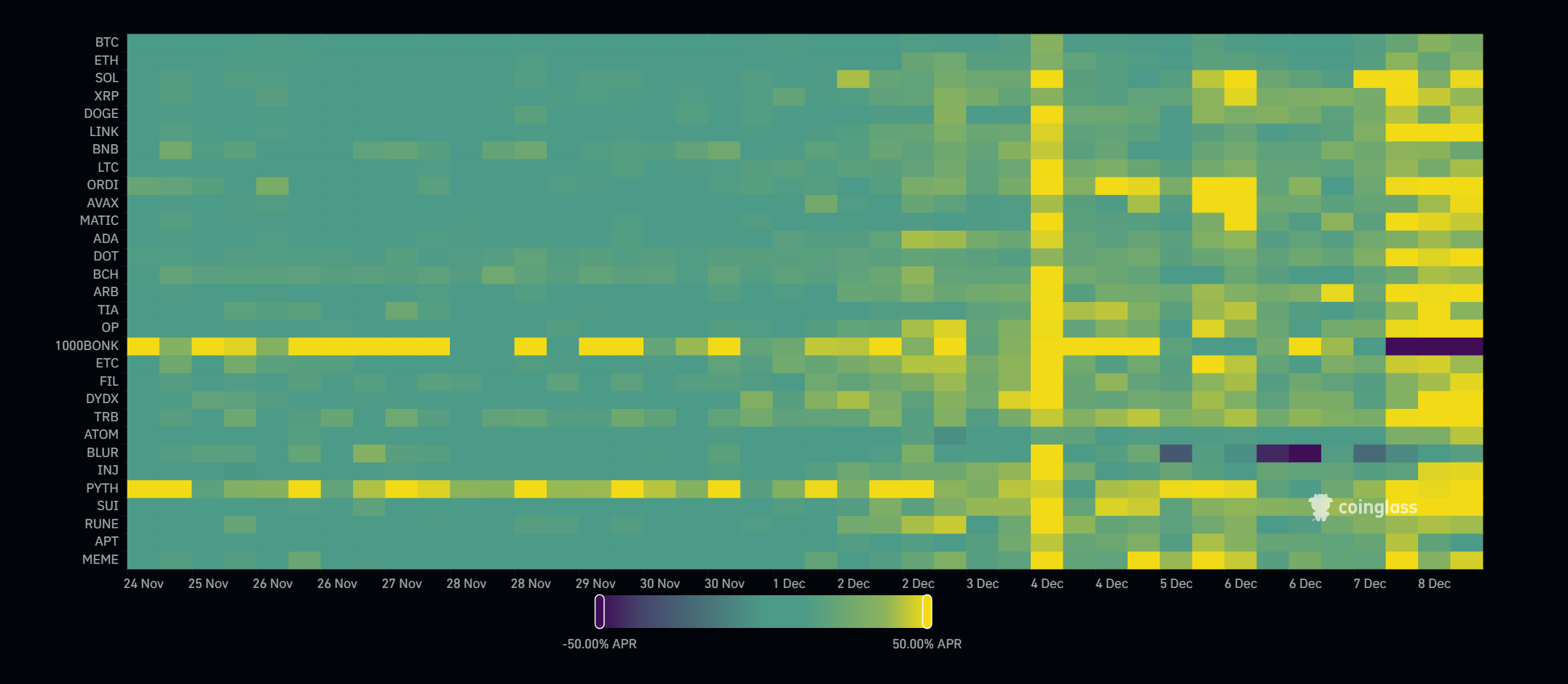

There’s always a but. We are stretching further and further away from any kind of moving average or fair price quantitative valuation. At some point that elastic band is going to stretch too far and we are going to see the markets snap back. To understand if we are overdue a correction we need to look into what is driving the current market push and how sustainable the current prices are. Spot ETF SpeculationI wrote about this last week so I wont spend too long talking about the expected Bitcoin Spot ETF approvals which people smarter than myself are predicting could happen as soon as January next year. There is no doubt large amounts of capital, including from traditional finance firms, are trying to front run the ETF’s. There’s a dynamic where, come tax season, a lot of family offices and high net worth individuals will have the option to allocate 1% to Bitcoin via their stock brokerage accounts. Who Is “So Back”?Crypto is getting exciting again, people are checking back in to their wallets for the first time in months. We aren’t at the stage yet where we are getting phone calls from relatives or Robinhood traders are eyeing up their next memecoin short squeeze but there’s a return of interest. The first signs of life in a resuscitation of attention in crypto markets. Futures Funding RatesPerp trading is slowly starting to make a come back and there is growing demand for leverage. This opens up a nice potential cash and carry trade which is delta neutral, short ETH futures to collect the funding rate, long spot stETH to collect the staking rewards. Something I’ll write about in a future post. Main point is that we are starting to see some leverage come back in to the system. We haven’t seen any liquidation cascades and scam wicks into liquidity to hunt stop losses for a while (Arthur & Alameda where are you?). I don’t see this as a long-term change to market dynamics and expect we will see a flush of leverage at some point, as has always been the case. Supply SideThere’s growing demand and as markets go up, they capture more attention, bringing more demand. On the supply side where is that demand likely to meet some sell side liquidity? There’s euphoria in the markets but did is anyone with substantial long-term holdings planning on selling bags they picked up in 2022 at this level? No one I know is. Perhaps that’s greed and will come back to bite us but there’s a significant lack of supply prior to $90k in my opinion. Is It Sustainable?The big question is whether the run up is sustainable or are we going to see a correction in the coming weeks. Truth is no one knows but there is a considerable bid, a lack of supply and growing leverage. This imbalance in the markets is causing the price to run up. The demand should be sustainable as TradFi money flows in, the supply isn’t going to open up at this level in my opinion so the only cause for concern is the growing leverage. This isn’t at crazy bull market levels yet but it is worth keeping an eye on as it is cyclical in nature. The chart looks due for a pull back but the way it flew through $42k was mind blowing. It’s the first time in a while I’ve watched the Bitcoin 1 min chart in awe. If there is a pull back there are plenty of support levels to offer a chance for anyone still sidelined to take a position. Ideal scenario is Bitcoin chills before the next leg up and alts play catch up. More on this below.

Bitcoin is pumping but also keep an eye on ETH/BTC and the 0.05 and 0.06 level. A significant market sell off could see this drop below 0.05 which would be a dark time for Ethereans. My hope is that the Bitcoin bid is sustainable, and we see a breakout above 0.06. This would be a strong indicator that we might get an altseason. Altseason is fabled time of the year which creates the biggest opportunity for speculation in crypto. It’s easy mode for degens, day traders and amateur system traders. Wishful thinking perhaps but Bitcoin going up, Ethereum going up more and Alts doubling over night is the promised light at the end of a long bear market tunnel. Let it be so. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "What Is Pushing Crypto Prices Up?"