It is with pleasure that I am able to offer my crypto market thesis for 2024. This lays out how I am thinking about and positioning for the next stage of the market cycle.

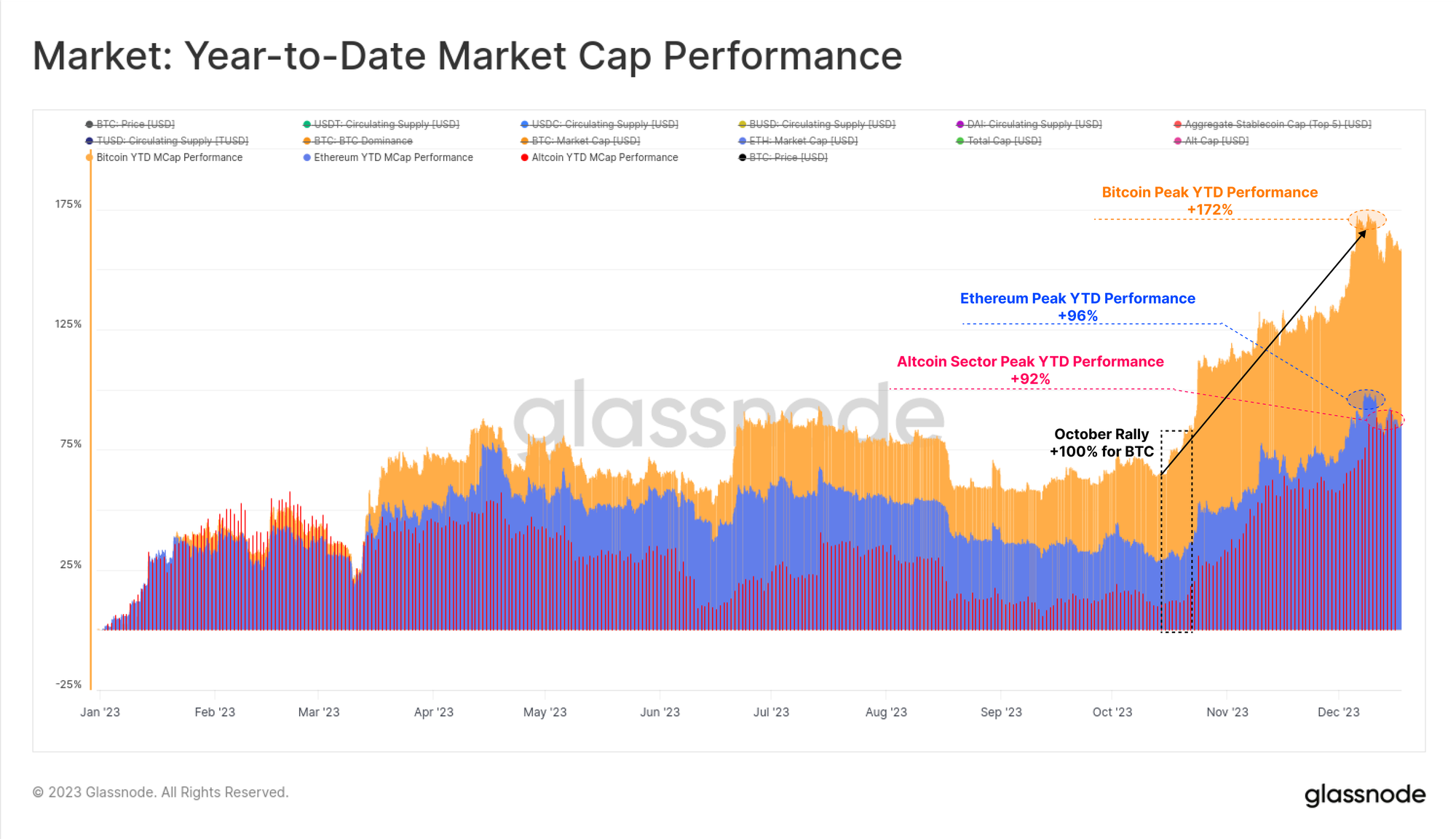

Executive Summary2023 marked a recovery phase for the crypto market, with significant price appreciation across digital assets. Bitcoin started the year at $16,500 and is ending it above $40,000 USD. Regulatory threats intensified, impacting the industry, particularly the centralized exchange landscape with US exchanges such as Coinbase likely to benefit. The upcoming Bitcoin halving in April 2024 is expected to influence market dynamics significantly, as it has historically been a catalyst for market rallies. The potential approval of a Bitcoin spot ETF in Q1 could open the market to institutional investors, with expectations of a significant inflow of capital as ETFs fill up. It’s an election year and the expected FED reversal of interest rate hikes is anticipated to positively impact risk assets, including cryptocurrencies. Ethereum is expected to maintain its market leading position in the smart contract space. The EIP4844 upgrade, expected in April, is significant for Ethereum’s long-term scaling efforts and directly benefits transaction costs on L2’s. DeFi remains a key sector with potential for growth, particularly in areas like real world asset tokenization and liquid staking derivatives where sustainable business models are being established. You can read more in the blog post if you don’t want to download the PDF: https://jamesbachini.com/crypto-market-thesis-2024/ Crypto markets have been relatively subdued as we’ve ranged and cooled off since the previous run up at the start of December. With speculation over the Bitcoin spot ETFs being approved as early as the first week of January all eyes are on how the market will react to the news flow. Growing speculation that we might see a sell the news event on day 1. I’m not convinced this will have much legs as the ETF managers are going to be competing against each other to grow AUM as fast as possible and establish market share. The inflow of capital to the ETF’s can only create additional demand on exchange for Bitcoin in Q1. Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Crypto Market Thesis 2024"