Order flow is the measure and analysis of buying and selling pressure for current and future market participants. It provides traders with insights into market trends, sentiments and the overall momentum of a digital asset.

While it is impossible to have perfect information, we can do a rough calculation on the known inflows and outflows. Inflows

Outflows

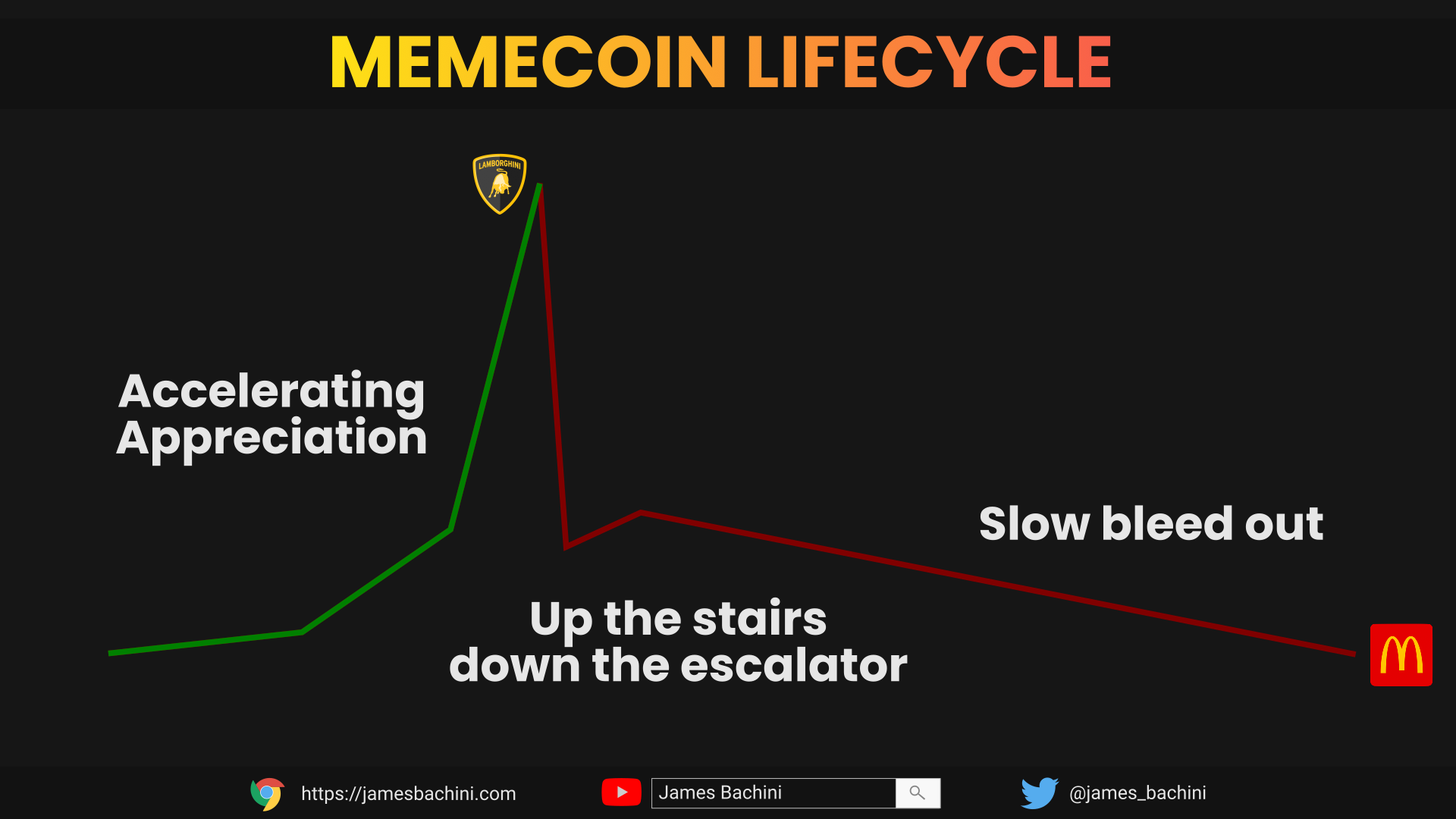

In a bull market when new money is pouring in to the sector and looking for a home, new participant inflows dominate everything else. However, in a bear market, new supply and unlocks create a headwind and new participant flows should be modeled as rotations due to narratives across the industry. Practical Ways To Trade Order FlowTraders can use various tools to analyze order flow, including screeners, heatmaps, unlock calendars and network inflows. For instance, if a new network, most recently Base, is getting a lot of ETH bridged in, it might be an idea to focus attention on that ecosystem. When researching new projects consider how early you actually are. Is there still a significant number of investors that are going to discover this and allocate capital in the near-term. How can this discovery stage be modeled relative to similar digital assets in the past?

By modeling order flows, traders can make more informed decisions and potentially avoid becoming bag holders during that slow bleed out stage where no new money is coming in. If you are really early to a new project that has significant potential then it’s a big opportunity. This is more rare in bear markets because good projects sand bag their development waiting for favorable market conditions (and users) to launch. In my experience “being early” happens most often when conducting my own internal research. By the time I hear about something on Twitter, it’s likely too late. Do your own research and don’t follow the herd to become exit liquidity for someone else’s bags. ethLondon Hackathon Write UpIncredible event, thank you to Encode Club for organizing and making it a success. Our team was lucky enough to be considered as one of the top 10 finalists and walked away with a $2.5k bounty from Wormhole. The product we created was a multichain staked Ethereum token which aggregated stETH and rETH and then bridged the ERC20 to Aurora using the Wormhole messaging coms. Source code here (not production ready, only on testnet, beware of scams): https://github.com/jamesbachini/ethLondon-Hackathon Recent Research PostsRecent News, Articles & SpeculationGood morning and welcome to your weekly blockchain briefing.

Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Trading Order Flow In Crypto"