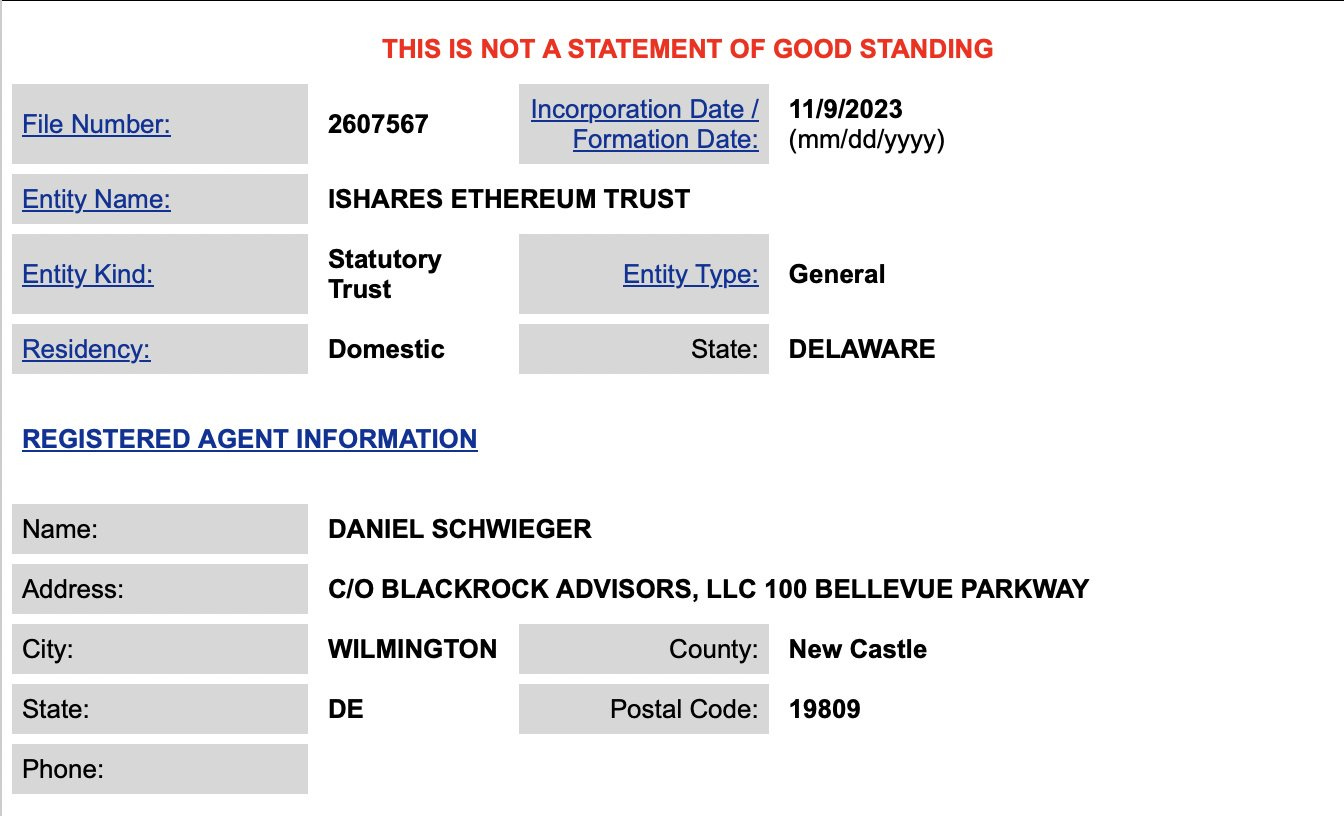

Bitcoin is up over 100% since the start of the year where it opened at $16,539 USD. Ethereum is pumping today on the news that Blackrock registered “iShares Ethereum Trust” in Delaware, with traders speculating on a potential spot ETH ETF.

Sentiment is shifting and we are seeing the first stages of investors starting to accept more risk and actively looking for opportunities. Yield farming is making a comeback and DeFi protocols are growing in TVL and the ever elusive user numbers. Yey! Are We Getting Ahead Of Ourselves?Bitcoin is bid, there’s no doubt about it that there is at least one major source of capital inflow. Bitfinex, Binance and Coinbase are all seeing programmatic orders relentlessly pushed through. It reminds me a little of when Michael Saylor’s Microstrategy started accumulating Bitcoin at any price. Perhaps a big private fund or trading desk is taking a position or the ETF players like Blackrock are looking for exposure prior to the ETF’s going live. That bid is slowly trickling down to all the other digital assets. First Bitcoin, then ETH, then altcoins (remember altszn?). I’ve said it before but altseason is the period of maximum opportunity in crypto markets. Fortunes can be made and lost in a very short period of time as low cap tokens become established mid cap assets. I get the impression that many crypto natives were sidelined after risking off in the bear market and are now scrambling to get back into crypto. Anyone short or neutral over the last 3 months has missed out significantly or worse. The last major correction and flush of leveraged long positions was back in mid August. Exuberance Of The Crypto ComebackEuphoria is in the air and it’s easy to think this will keep going up forever however that unfortunately wont be the case.

I expect we will soon see one such significant pull back. I don’t have the conviction to sell of my position or even take a short or put option to hedge it. But base case is we are getting ahead of ourselves and a potential post-halving bull market. Many players in the industry have a vested interest in keeping the 4 year Bitcoin cycle ticking over like clockwork and the markets do need to make a new ATH over the next couple of years to “keep crypto interesting”. If-When the Bitcoin spot ETF gets approved we are likely to see an initial surge, this was tested with the CoinTelegraph fake news a few weeks ago. Following the trade I expect a prolonged increase in demand as the Bitcoin ETF’s fill up and the underlying collateral needed to support them is taken out of the market. If we are trading above $40k when that happens it’s going to very quickly push us up in to that ATH region in the $60k’s. Mainstream media will start paying attention and mainstream speculators return. While writing this I’ve had an alarm go off as ETH just exceeded $2000 USD 🍾🥂 It’s obviously been a great few months for anyone with crypto exposure and I don’t want to put a downer on the party but I wouldn’t hate a slowdown or minor correction between now and the end of the year. 🔍 Independent Research📰 News, Articles & Speculation

Social links are below and if you enjoyed this newsletter I would appreciate it if you could share this content 📰 https://bachini.substack.com 📺 https://www.youtube.com/c/JamesBachini 🐥 https://twitter.com/james_bachini 👨💻 https://github.com/jamesbachini |

.

Copyright © 2015 : All.Semua

0 Komentar untuk "Bitcoin Bid, iShares Ethereum Trust, Proceed With Caution"